|

|

|

Drug abusers experience the following scenario: The pleasure given by their drug (or drugs) of choice is so strong that it is difficult to eradicate even after years of staying away from the substances involved. Certain triggers may cause a drug abuser to relapse. Research shows that long-term drug abuse results in significant changes in brain function that persist long after an individual stops using drugs. It is most important to realize that the same is true of not just illegal substances but alcohol and tobacco as well.

An identified risk factor for osteoporosis is the intake of excessive amounts of vitamin A. Dietary intake of approximately double the recommended daily amount of vitamin A, by women, has been shown to reduce bone mineral density and increase the chances for hip fractures compared with women who consumed the recommended daily amount (or less) of vitamin A.

Though the United States has largely rejected the metric system, it is used for currency, as in 100 pennies = 1 dollar. Previously, the British currency system was used, with measurements such as 12 pence to the shilling, and 20 shillings to the pound.

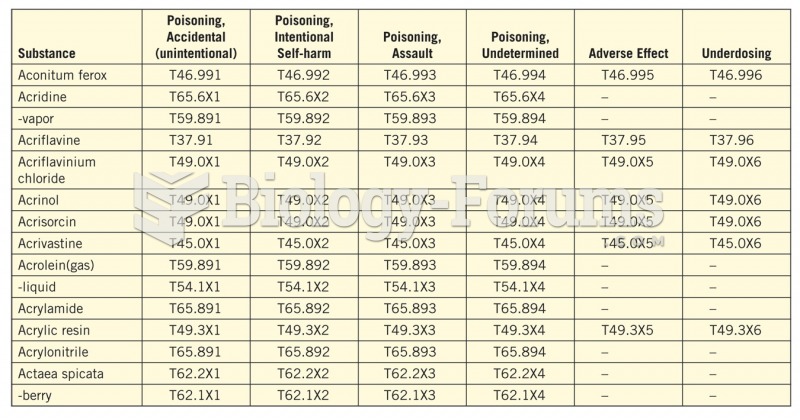

Women are 50% to 75% more likely than men to experience an adverse drug reaction.

The heart is located in the center of the chest, with part of it tipped slightly so that it taps against the left side of the chest.