|

|

|

Every flu season is different, and even healthy people can get extremely sick from the flu, as well as spread it to others. The flu season can begin as early as October and last as late as May. Every person over six months of age should get an annual flu vaccine. The vaccine cannot cause you to get influenza, but in some seasons, may not be completely able to prevent you from acquiring influenza due to changes in causative viruses. The viruses in the flu shot are killed—there is no way they can give you the flu. Minor side effects include soreness, redness, or swelling where the shot was given. It is possible to develop a slight fever, and body aches, but these are simply signs that the body is responding to the vaccine and making itself ready to fight off the influenza virus should you come in contact with it.

The average office desk has 400 times more bacteria on it than a toilet.

Barbituric acid, the base material of barbiturates, was first synthesized in 1863 by Adolph von Bayer. His company later went on to synthesize aspirin for the first time, and Bayer aspirin is still a popular brand today.

More than one-third of adult Americans are obese. Diseases that kill the largest number of people annually, such as heart disease, cancer, diabetes, stroke, and hypertension, can be attributed to diet.

According to the CDC, approximately 31.7% of the U.S. population has high low-density lipoprotein (LDL) or "bad cholesterol" levels.

In 1839 Mary Cragin, at the age of twenty-nine, became a convert to John Humphrey Noyes’s “communism

In 1839 Mary Cragin, at the age of twenty-nine, became a convert to John Humphrey Noyes’s “communism

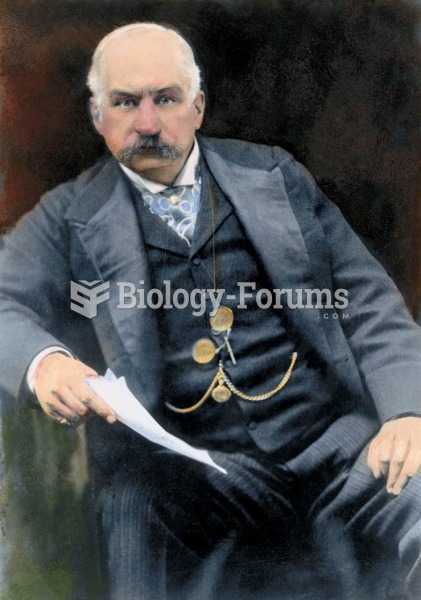

J. P. Morgan, the financial genius, staved off ruinous competition among steel firms by combining mo

J. P. Morgan, the financial genius, staved off ruinous competition among steel firms by combining mo