|

|

|

Oxytocin is recommended only for pregnancies that have a medical reason for inducing labor (such as eclampsia) and is not recommended for elective procedures or for making the birthing process more convenient.

Giardia is one of the most common intestinal parasites worldwide, and infects up to 20% of the world population, mostly in poorer countries with inadequate sanitation. Infections are most common in children, though chronic Giardia is more common in adults.

People who have myopia, or nearsightedness, are not able to see objects at a distance but only up close. It occurs when the cornea is either curved too steeply, the eye is too long, or both. This condition is progressive and worsens with time. More than 100 million people in the United States are nearsighted, but only 20% of those are born with the condition. Diet, eye exercise, drug therapy, and corrective lenses can all help manage nearsightedness.

Women are two-thirds more likely than men to develop irritable bowel syndrome. This may be attributable to hormonal changes related to their menstrual cycles.

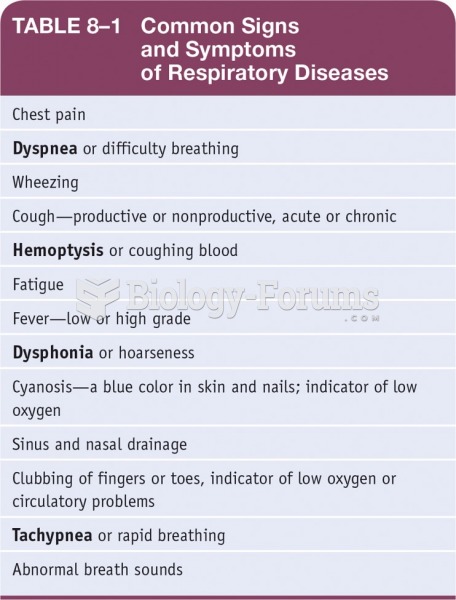

According to the National Institute of Environmental Health Sciences, lung disease is the third leading killer in the United States, responsible for one in seven deaths. It is the leading cause of death among infants under the age of one year.