|

|

|

Pubic lice (crabs) are usually spread through sexual contact. You cannot catch them by using a public toilet.

The Centers for Disease Control and Prevention has released reports detailing the deaths of infants (younger than 1 year of age) who died after being given cold and cough medications. This underscores the importance of educating parents that children younger than 2 years of age should never be given over-the-counter cold and cough medications without consulting their physicians.

Earwax has antimicrobial properties that reduce the viability of bacteria and fungus in the human ear.

To prove that stomach ulcers were caused by bacteria and not by stress, a researcher consumed an entire laboratory beaker full of bacterial culture. After this, he did indeed develop stomach ulcers, and won the Nobel Prize for his discovery.

A serious new warning has been established for pregnant women against taking ACE inhibitors during pregnancy. In the study, the risk of major birth defects in children whose mothers took ACE inhibitors during the first trimester was nearly three times higher than in children whose mothers didn't take ACE inhibitors. Physicians can prescribe alternative medications for pregnant women who have symptoms of high blood pressure.

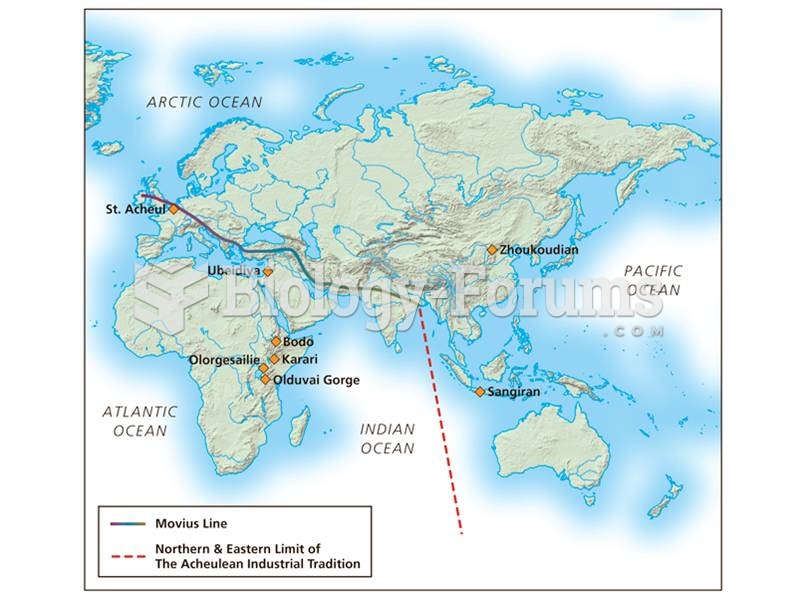

The Movius line separates regions of the world where Acheulean hand axes were made from regions wher

The Movius line separates regions of the world where Acheulean hand axes were made from regions wher

When the United States gets stuck over a controversial issue—usually something a divided Congress ca

When the United States gets stuck over a controversial issue—usually something a divided Congress ca