|

|

|

Walt Disney helped combat malaria by making an animated film in 1943 called The Winged Scourge. This short film starred the seven dwarfs and taught children that mosquitos transmit malaria, which is a very bad disease. It advocated the killing of mosquitos to stop the disease.

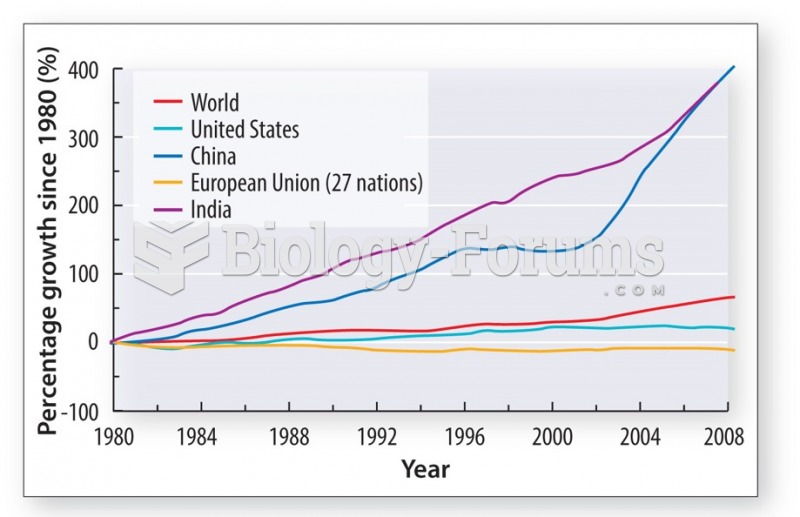

Cancer has been around as long as humankind, but only in the second half of the twentieth century did the number of cancer cases explode.

All adverse reactions are commonly charted in red ink in the patient's record and usually are noted on the front of the chart. Failure to follow correct documentation procedures may result in malpractice lawsuits.

Hippocrates noted that blood separates into four differently colored liquids when removed from the body and examined: a pure red liquid mixed with white liquid material with a yellow-colored froth at the top and a black substance that settles underneath; he named these the four humors (for blood, phlegm, yellow bile, and black bile).

Barbituric acid, the base material of barbiturates, was first synthesized in 1863 by Adolph von Bayer. His company later went on to synthesize aspirin for the first time, and Bayer aspirin is still a popular brand today.

Proper placement and monitoring of an automatic blood pressure cuff will reduce the risk of injury o

Proper placement and monitoring of an automatic blood pressure cuff will reduce the risk of injury o

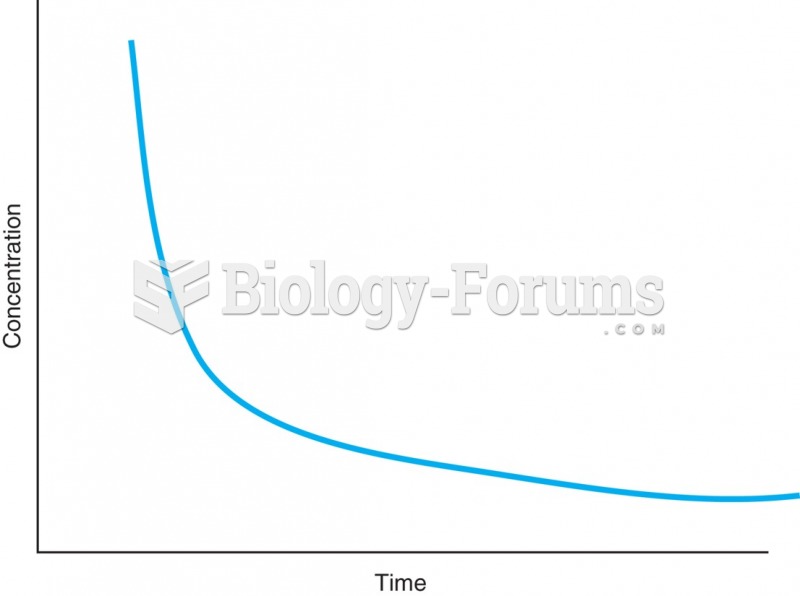

Most drugs exhibit first-order elimination, in which the rate of drug elimination is equivalent to ...

Most drugs exhibit first-order elimination, in which the rate of drug elimination is equivalent to ...