|

|

|

No drugs are available to relieve parathyroid disease. Parathyroid disease is caused by a parathyroid tumor, and it needs to be removed by surgery.

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

More than 50% of American adults have oral herpes, which is commonly known as "cold sores" or "fever blisters." The herpes virus can be active on the skin surface without showing any signs or causing any symptoms.

The U.S. Pharmacopeia Medication Errors Reporting Program states that approximately 50% of all medication errors involve insulin.

Chronic necrotizing aspergillosis has a slowly progressive process that, unlike invasive aspergillosis, does not spread to other organ systems or the blood vessels. It most often affects middle-aged and elderly individuals, spreading to surrounding tissue in the lungs. The disease often does not respond to conventionally successful treatments, and requires individualized therapies in order to keep it from becoming life-threatening.

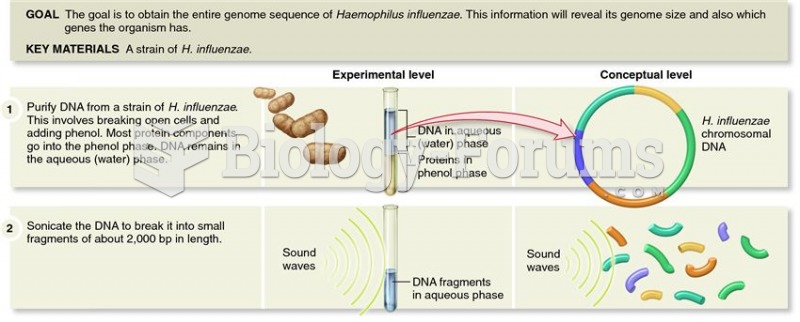

Determination of the complete genome sequence of Haemophilus influenzae by Venter, Smith, and collea

Determination of the complete genome sequence of Haemophilus influenzae by Venter, Smith, and collea

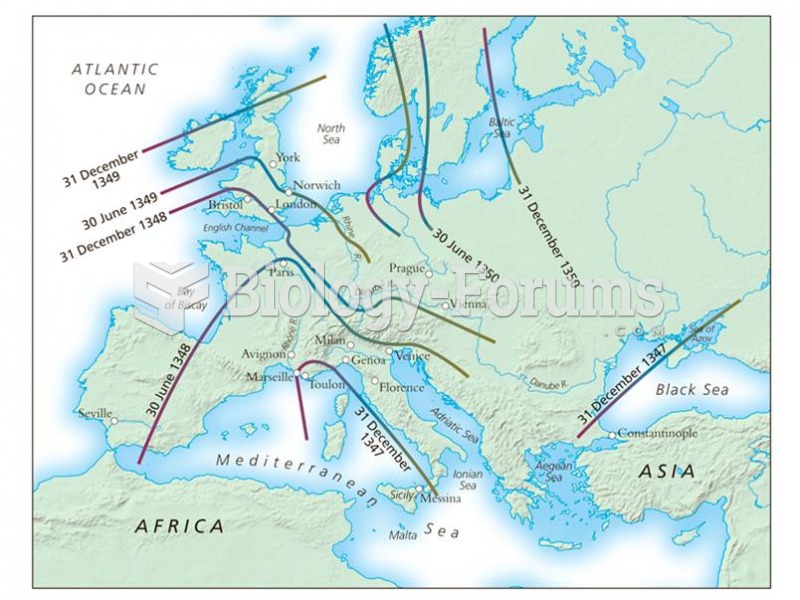

The Black Death spread over much of Europe in a three-year period in the middle of the fourteenth ce

The Black Death spread over much of Europe in a three-year period in the middle of the fourteenth ce

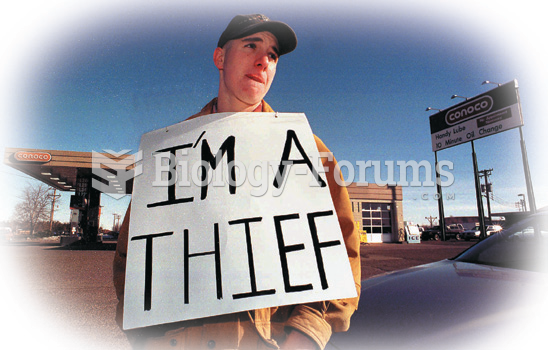

This 19-year-old in Wisconsin was given a reduced jail sentence for holding this sign in front of ...

This 19-year-old in Wisconsin was given a reduced jail sentence for holding this sign in front of ...

The hatred and vengeance of adults become the children’s heritage. The headband of this 4-year-old ...

The hatred and vengeance of adults become the children’s heritage. The headband of this 4-year-old ...