|

|

|

On average, someone in the United States has a stroke about every 40 seconds. This is about 795,000 people per year.

People who have myopia, or nearsightedness, are not able to see objects at a distance but only up close. It occurs when the cornea is either curved too steeply, the eye is too long, or both. This condition is progressive and worsens with time. More than 100 million people in the United States are nearsighted, but only 20% of those are born with the condition. Diet, eye exercise, drug therapy, and corrective lenses can all help manage nearsightedness.

More than 50% of American adults have oral herpes, which is commonly known as "cold sores" or "fever blisters." The herpes virus can be active on the skin surface without showing any signs or causing any symptoms.

The shortest mature adult human of whom there is independent evidence was Gul Mohammed in India. In 1990, he was measured in New Delhi and stood 22.5 inches tall.

The average person is easily confused by the terms pharmaceutics and pharmacology, thinking they are one and the same. Whereas pharmaceutics is the science of preparing and dispensing drugs (otherwise known as the science of pharmacy), pharmacology is the study of medications.

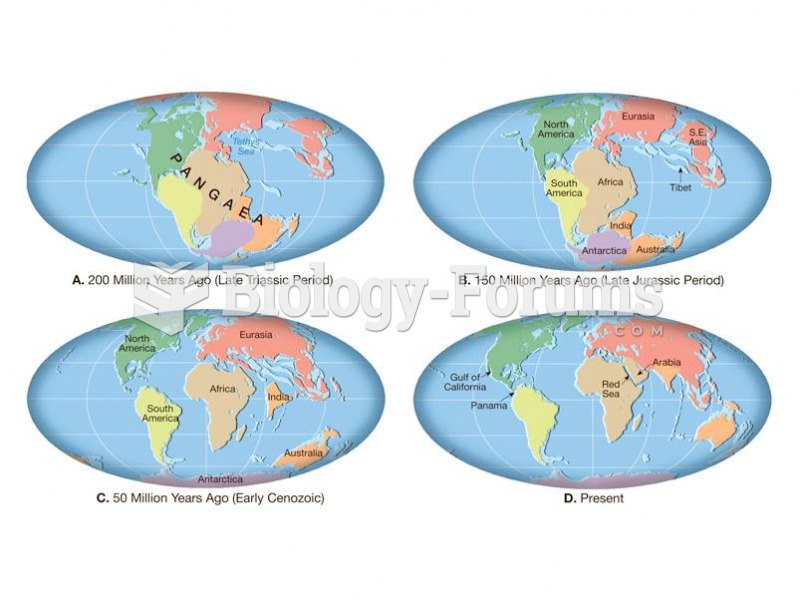

The continents were not always in their present positions. The position of the continents is importa

The continents were not always in their present positions. The position of the continents is importa

American soldiers advance past a burning oil well. As the routed Iraqi army fled Kuwait, it ignited ...

American soldiers advance past a burning oil well. As the routed Iraqi army fled Kuwait, it ignited ...