|

|

|

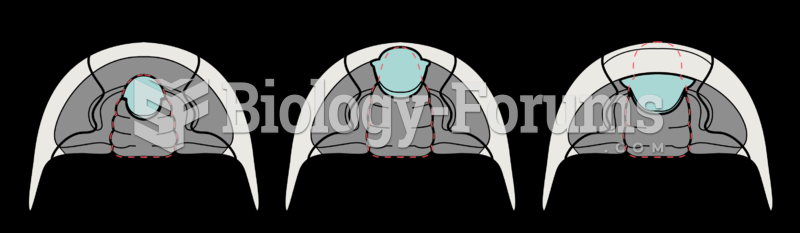

Signs and symptoms that may signify an eye tumor include general blurred vision, bulging eye(s), double vision, a sensation of a foreign body in the eye(s), iris defects, limited ability to move the eyelid(s), limited ability to move the eye(s), pain or discomfort in or around the eyes or eyelids, red or pink eyes, white or cloud spots on the eye(s), colored spots on the eyelid(s), swelling around the eyes, swollen eyelid(s), and general vision loss.

In the ancient and medieval periods, dysentery killed about ? of all babies before they reach 12 months of age. The disease was transferred through contaminated drinking water, because there was no way to adequately dispose of sewage, which contaminated the water.

Excessive alcohol use costs the country approximately $235 billion every year.

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

If you use artificial sweeteners, such as cyclamates, your eyes may be more sensitive to light. Other factors that will make your eyes more sensitive to light include use of antibiotics, oral contraceptives, hypertension medications, diuretics, and antidiabetic medications.