|

|

|

Certain chemicals, after ingestion, can be converted by the body into cyanide. Most of these chemicals have been removed from the market, but some old nail polish remover, solvents, and plastics manufacturing solutions can contain these substances.

The newest statin drug, rosuvastatin, has been called a superstatin because it appears to reduce LDL cholesterol to a greater degree than the other approved statin drugs.

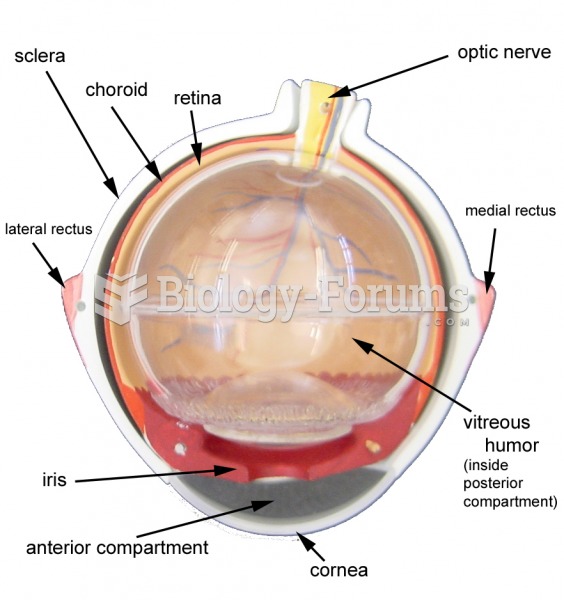

Looking at the sun may not only cause headache and distort your vision temporarily, but it can also cause permanent eye damage. Any exposure to sunlight adds to the cumulative effects of ultraviolet (UV) radiation on your eyes. UV exposure has been linked to eye disorders such as macular degeneration, solar retinitis, and corneal dystrophies.

Alzheimer's disease affects only about 10% of people older than 65 years of age. Most forms of decreased mental function and dementia are caused by disuse (letting the mind get lazy).

Fungal nail infections account for up to 30% of all skin infections. They affect 5% of the general population—mostly people over the age of 70.