|

|

|

According to the Migraine Research Foundation, migraines are the third most prevalent illness in the world. Women are most affected (18%), followed by children of both sexes (10%), and men (6%).

Your skin wrinkles if you stay in the bathtub a long time because the outermost layer of skin (which consists of dead keratin) swells when it absorbs water. It is tightly attached to the skin below it, so it compensates for the increased area by wrinkling. This happens to the hands and feet because they have the thickest layer of dead keratin cells.

The most destructive flu epidemic of all times in recorded history occurred in 1918, with approximately 20 million deaths worldwide.

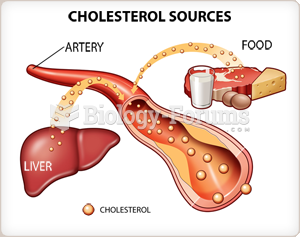

According to the CDC, approximately 31.7% of the U.S. population has high low-density lipoprotein (LDL) or "bad cholesterol" levels.

Medication errors are more common among seriously ill patients than with those with minor conditions.