|

|

|

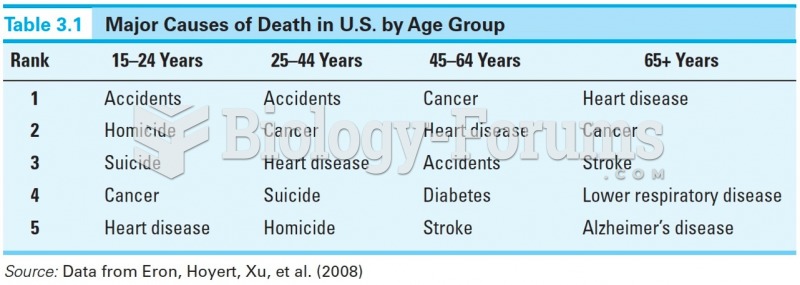

Elderly adults are living longer, and causes of death are shifting. At the same time, autopsy rates are at or near their lowest in history.

Recent studies have shown that the number of medication errors increases in relation to the number of orders that are verified per pharmacist, per work shift.

Approximately 15–25% of recognized pregnancies end in miscarriage. However, many miscarriages often occur before a woman even knows she is pregnant.

Lower drug doses for elderly patients should be used first, with titrations of the dose as tolerated to prevent unwanted drug-related pharmacodynamic effects.

Congestive heart failure is a serious disorder that carries a reduced life expectancy. Heart failure is usually a chronic illness, and it may worsen with infection or other physical stressors.