|

|

|

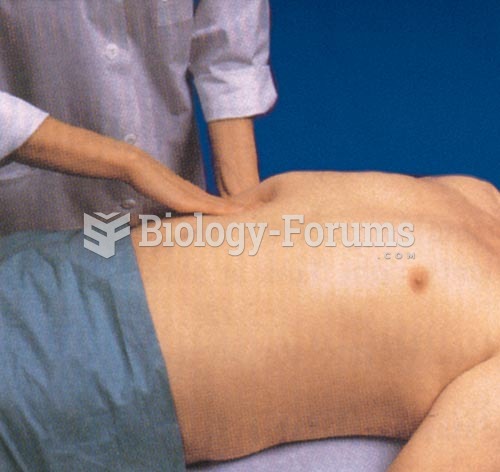

Many people have small pouches in their colons that bulge outward through weak spots. Each pouch is called a diverticulum. About 10% of Americans older than age 40 years have diverticulosis, which, when the pouches become infected or inflamed, is called diverticulitis. The main cause of diverticular disease is a low-fiber diet.

The people with the highest levels of LDL are Mexican American males and non-Hispanic black females.

In the United States, an estimated 50 million unnecessary antibiotics are prescribed for viral respiratory infections.

Vampire bats have a natural anticoagulant in their saliva that permits continuous bleeding after they painlessly open a wound with their incisors. This capillary blood does not cause any significant blood loss to their victims.

The immune system needs 9.5 hours of sleep in total darkness to recharge completely.