|

|

|

Inotropic therapy does not have a role in the treatment of most heart failure patients. These drugs can make patients feel and function better but usually do not lengthen the predicted length of their lives.

By definition, when a medication is administered intravenously, its bioavailability is 100%.

Thyroid conditions cause a higher risk of fibromyalgia and chronic fatigue syndrome.

Blastomycosis is often misdiagnosed, resulting in tragic outcomes. It is caused by a fungus living in moist soil, in wooded areas of the United States and Canada. If inhaled, the fungus can cause mild breathing problems that may worsen and cause serious illness and even death.

The most common treatment options for addiction include psychotherapy, support groups, and individual counseling.

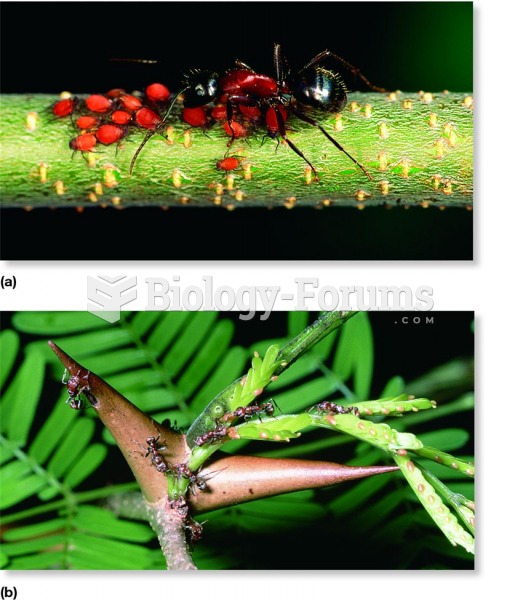

Defensive mutualism involves species that receive food or shelter in return for providing protection

Defensive mutualism involves species that receive food or shelter in return for providing protection

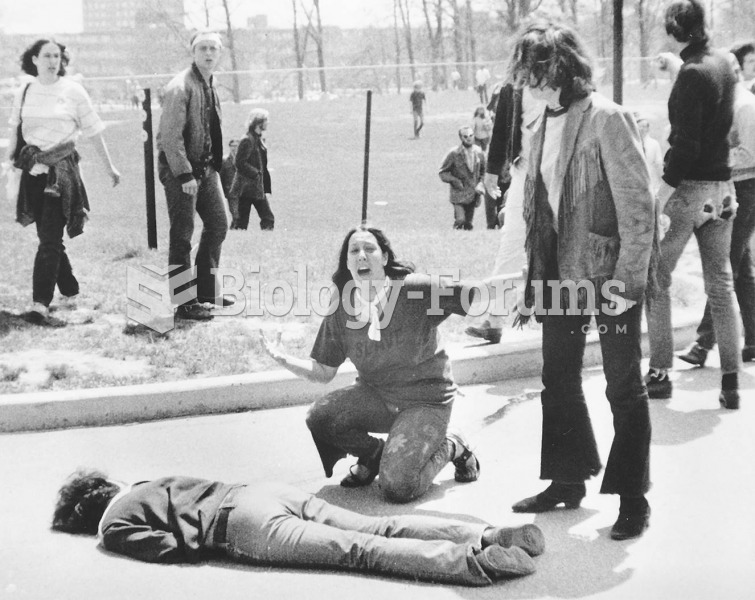

National Guardsmen firing into a crowd of antiwar protesters at Kent State University killed four ...

National Guardsmen firing into a crowd of antiwar protesters at Kent State University killed four ...