|

|

|

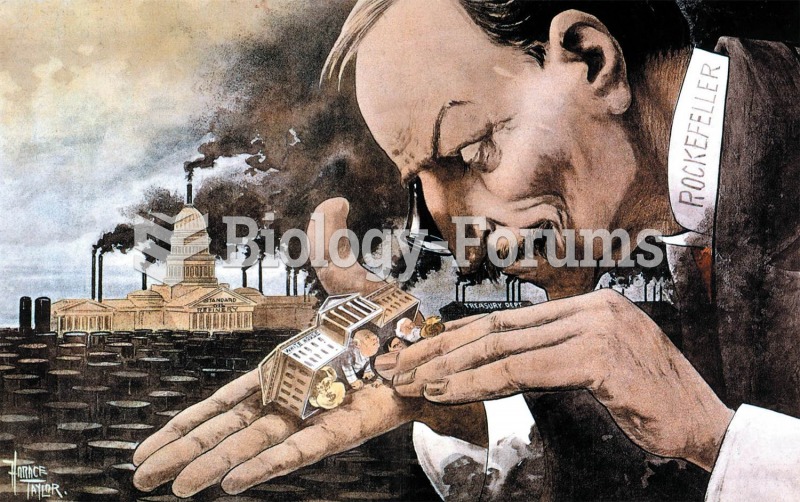

Cocaine was isolated in 1860 and first used as a local anesthetic in 1884. Its first clinical use was by Sigmund Freud to wean a patient from morphine addiction. The fictional character Sherlock Holmes was supposed to be addicted to cocaine by injection.

Allergies play a major part in the health of children. The most prevalent childhood allergies are milk, egg, soy, wheat, peanuts, tree nuts, and seafood.

Oxytocin is recommended only for pregnancies that have a medical reason for inducing labor (such as eclampsia) and is not recommended for elective procedures or for making the birthing process more convenient.

Street names for barbiturates include reds, red devils, yellow jackets, blue heavens, Christmas trees, and rainbows. They are commonly referred to as downers.

Eat fiber! A diet high in fiber can help lower cholesterol levels by as much as 10%.