|

|

|

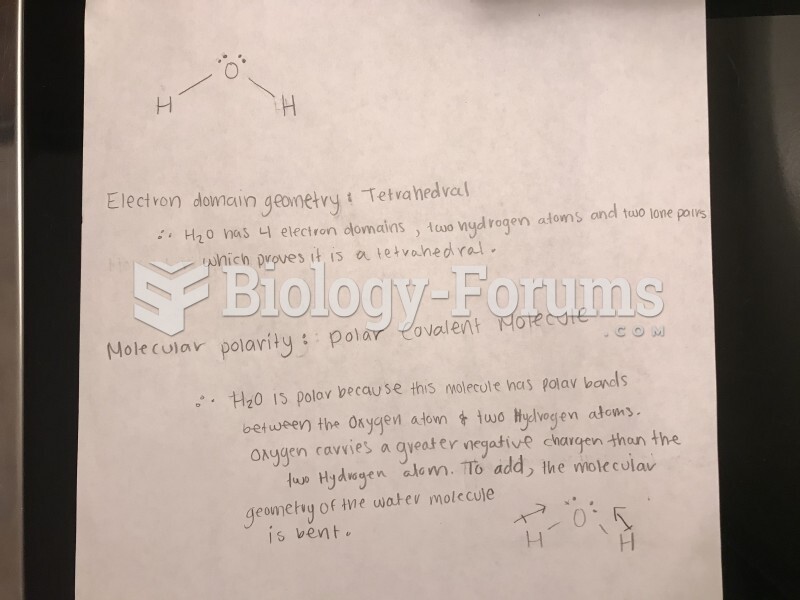

The ratio of hydrogen atoms to oxygen in water (H2O) is 2:1.

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

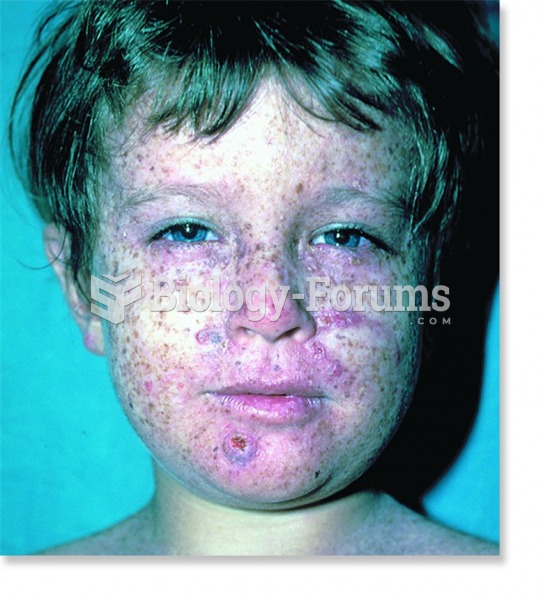

Stevens-Johnson syndrome and Toxic Epidermal Necrolysis syndrome are life-threatening reactions that can result in death. Complications include permanent blindness, dry-eye syndrome, lung damage, photophobia, asthma, chronic obstructive pulmonary disease, permanent loss of nail beds, scarring of mucous membranes, arthritis, and chronic fatigue syndrome. Many patients' pores scar shut, causing them to retain heat.

The FDA recognizes 118 routes of administration.

Patients who have been on total parenteral nutrition for more than a few days may need to have foods gradually reintroduced to give the digestive tract time to start working again.