|

|

|

About 100 new prescription or over-the-counter drugs come into the U.S. market every year.

Blastomycosis is often misdiagnosed, resulting in tragic outcomes. It is caused by a fungus living in moist soil, in wooded areas of the United States and Canada. If inhaled, the fungus can cause mild breathing problems that may worsen and cause serious illness and even death.

For high blood pressure (hypertension), a new class of drug, called a vasopeptidase blocker (inhibitor), has been developed. It decreases blood pressure by simultaneously dilating the peripheral arteries and increasing the body's loss of salt.

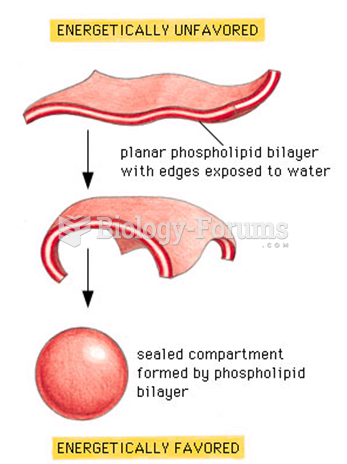

The lipid bilayer is made of phospholipids. They are arranged in a double layer because one of their ends is attracted to water while the other is repelled by water.

Lower drug doses for elderly patients should be used first, with titrations of the dose as tolerated to prevent unwanted drug-related pharmacodynamic effects.