This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Warfarin was developed as a consequence of the study of a strange bleeding disorder that suddenly occurred in cattle on the northern prairies of the United States in the early 1900s.

Did you know?

Normal urine is sterile. It contains fluids, salts, and waste products. It is free of bacteria, viruses, and fungi.

Did you know?

Fungal nail infections account for up to 30% of all skin infections. They affect 5% of the general population—mostly people over the age of 70.

Did you know?

Bacteria have flourished on the earth for over three billion years. They were the first life forms on the planet.

Did you know?

When blood is exposed to air, it clots. Heparin allows the blood to come in direct contact with air without clotting.

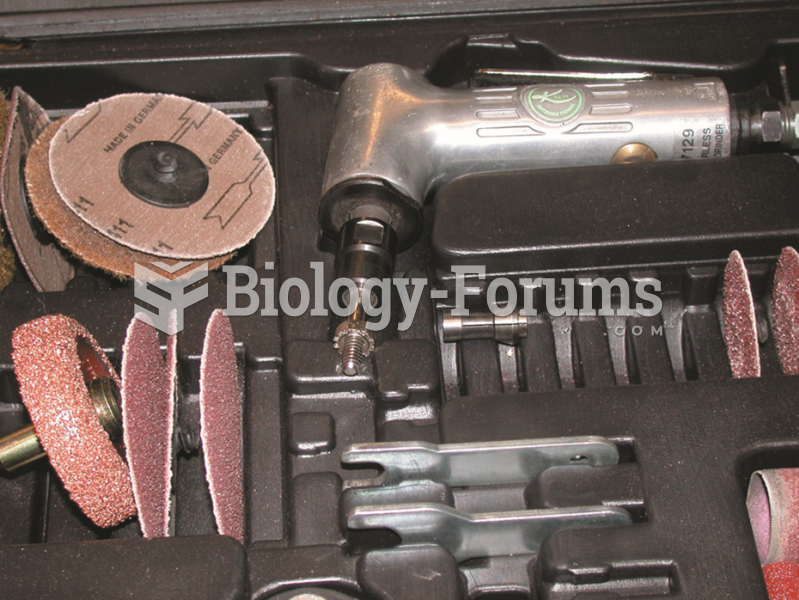

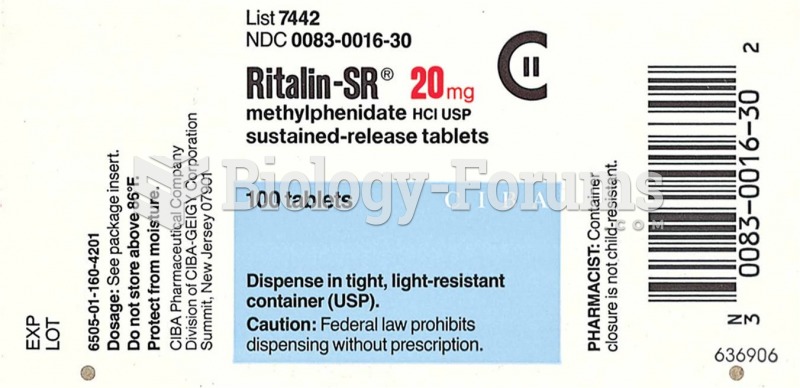

Examples of USP labels Source: Courtesy of Novartis Pharmaceuticals Corporation and Mallinckrodt Pha

Examples of USP labels Source: Courtesy of Novartis Pharmaceuticals Corporation and Mallinckrodt Pha

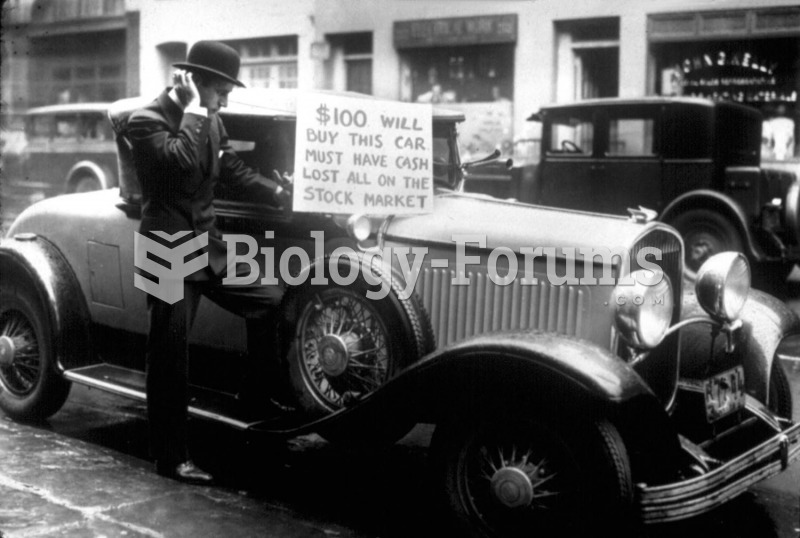

Walter Thompson saw his assets evaporate during the stock market collapse in 1929. Desperate for ...

Walter Thompson saw his assets evaporate during the stock market collapse in 1929. Desperate for ...