|

|

|

Blood in the urine can be a sign of a kidney stone, glomerulonephritis, or other kidney problems.

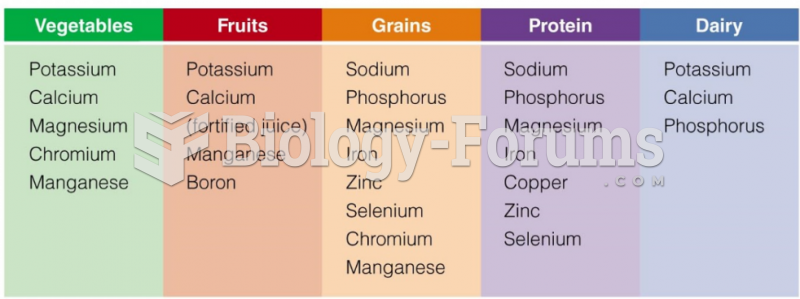

There are actually 60 minerals, 16 vitamins, 12 essential amino acids, and three essential fatty acids that your body needs every day.

The first-known contraceptive was crocodile dung, used in Egypt in 2000 BC. Condoms were also reportedly used, made of animal bladders or intestines.

The first monoclonal antibodies were made exclusively from mouse cells. Some are now fully human, which means they are likely to be safer and may be more effective than older monoclonal antibodies.

Coca-Cola originally used coca leaves and caffeine from the African kola nut. It was advertised as a therapeutic agent and "pickerupper." Eventually, its formulation was changed, and the coca leaves were removed because of the effects of regulation on cocaine-related products.