|

|

|

When Gabriel Fahrenheit invented the first mercury thermometer, he called "zero degrees" the lowest temperature he was able to attain with a mixture of ice and salt. For the upper point of his scale, he used 96°, which he measured as normal human body temperature (we know it to be 98.6° today because of more accurate thermometers).

Serum cholesterol testing in adults is recommended every 1 to 5 years. People with diabetes and a family history of high cholesterol should be tested even more frequently.

Bacteria have flourished on the earth for over three billion years. They were the first life forms on the planet.

The Romans did not use numerals to indicate fractions but instead used words to indicate parts of a whole.

After 5 years of being diagnosed with rheumatoid arthritis, one every three patients will no longer be able to work.

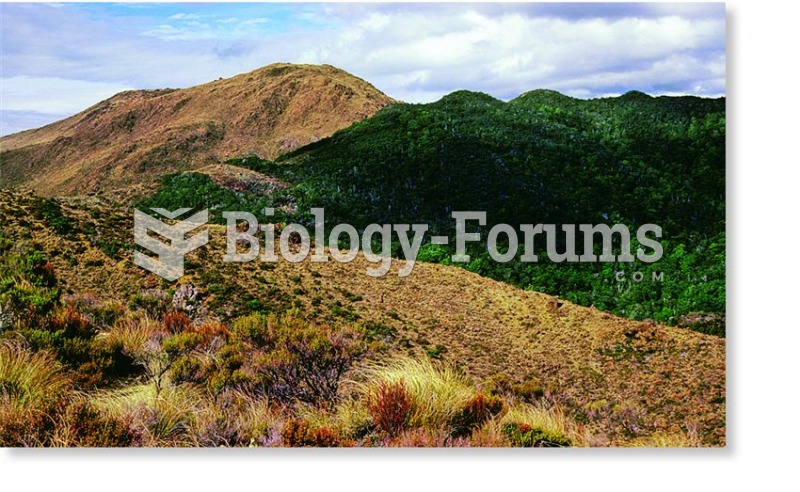

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

Hip Typically occurs as a result of a fall; with osteoporosis, hip fractures can occur as a result o

Hip Typically occurs as a result of a fall; with osteoporosis, hip fractures can occur as a result o

Eighteen-year-olds were the largest age cohort in the first year of the war in both armies. Soldiers

Eighteen-year-olds were the largest age cohort in the first year of the war in both armies. Soldiers