|

|

|

Not getting enough sleep can greatly weaken the immune system. Lack of sleep makes you more likely to catch a cold, or more difficult to fight off an infection.

The use of salicylates dates back 2,500 years to Hippocrates’s recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

Multiple experimental evidences have confirmed that at the molecular level, cancer is caused by lesions in cellular DNA.

Bisphosphonates were first developed in the nineteenth century. They were first investigated for use in disorders of bone metabolism in the 1960s. They are now used clinically for the treatment of osteoporosis, Paget's disease, bone metastasis, multiple myeloma, and other conditions that feature bone fragility.

The term pharmacology is derived from the Greek words pharmakon("claim, medicine, poison, or remedy") and logos ("study").

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

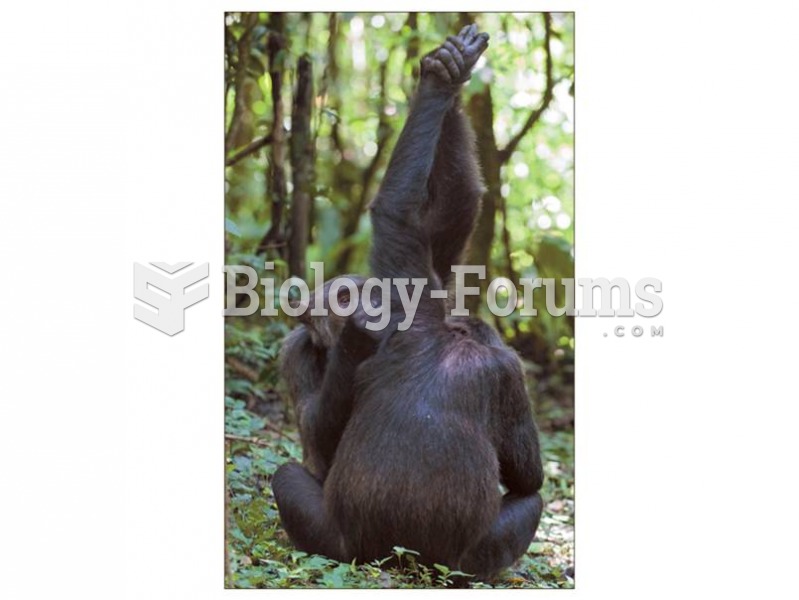

Chimpanzees in the Gombe National Park, Tanzania groom each other by holding an overhead branch with

Chimpanzees in the Gombe National Park, Tanzania groom each other by holding an overhead branch with