|

|

|

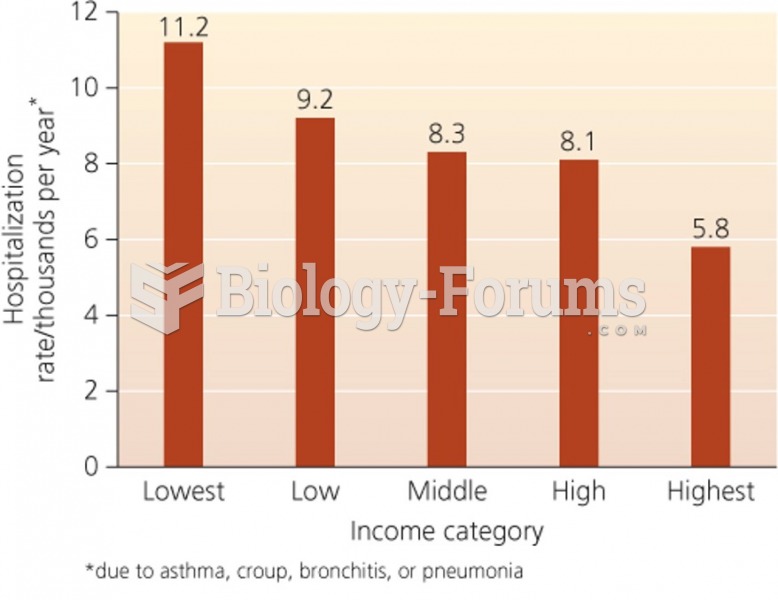

According to the National Institute of Environmental Health Sciences, lung disease is the third leading killer in the United States, responsible for one in seven deaths. It is the leading cause of death among infants under the age of one year.

The eye muscles are the most active muscles in the whole body. The external muscles that move the eyes are the strongest muscles in the human body for the job they have to do. They are 100 times more powerful than they need to be.

About 80% of major fungal systemic infections are due to Candida albicans. Another form, Candida peritonitis, occurs most often in postoperative patients. A rare disease, Candida meningitis, may follow leukemia, kidney transplant, other immunosuppressed factors, or when suffering from Candida septicemia.

Your skin wrinkles if you stay in the bathtub a long time because the outermost layer of skin (which consists of dead keratin) swells when it absorbs water. It is tightly attached to the skin below it, so it compensates for the increased area by wrinkling. This happens to the hands and feet because they have the thickest layer of dead keratin cells.

Fatal fungal infections may be able to resist newer antifungal drugs. Globally, fungal infections are often fatal due to the lack of access to multiple antifungals, which may be required to be utilized in combination. Single antifungals may not be enough to stop a fungal infection from causing the death of a patient.

Examples of USP labels Source: Courtesy of Novartis Pharmaceuticals Corporation and Mallinckrodt Pha

Examples of USP labels Source: Courtesy of Novartis Pharmaceuticals Corporation and Mallinckrodt Pha

Two lymphocytes that are reactive in a 19-year-old college student with infectious mononucleosis. ...

Two lymphocytes that are reactive in a 19-year-old college student with infectious mononucleosis. ...