This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

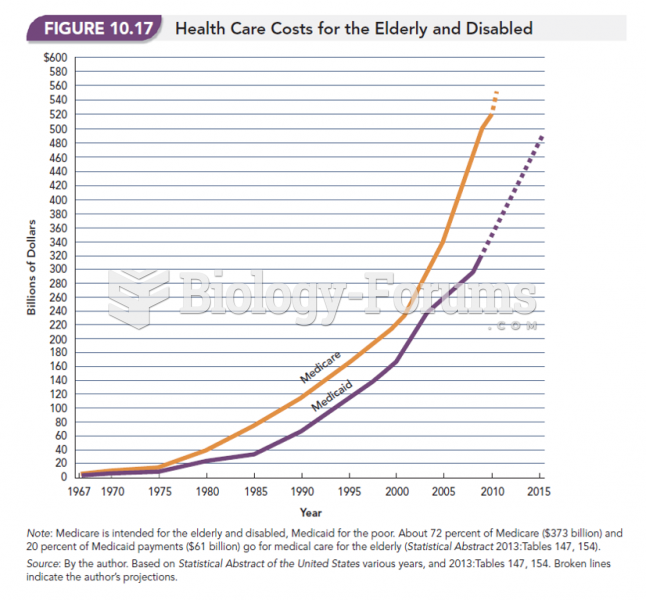

Elderly adults are living longer, and causes of death are shifting. At the same time, autopsy rates are at or near their lowest in history.

Did you know?

Lower drug doses for elderly patients should be used first, with titrations of the dose as tolerated to prevent unwanted drug-related pharmacodynamic effects.

Did you know?

Allergies play a major part in the health of children. The most prevalent childhood allergies are milk, egg, soy, wheat, peanuts, tree nuts, and seafood.

Did you know?

Atropine was named after the Greek goddess Atropos, the oldest and ugliest of the three sisters known as the Fates, who controlled the destiny of men.

Did you know?

Bacteria have been found alive in a lake buried one half mile under ice in Antarctica.