|

|

|

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

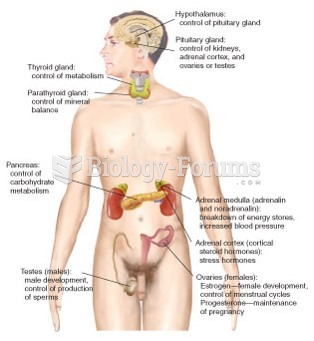

No drugs are available to relieve parathyroid disease. Parathyroid disease is caused by a parathyroid tumor, and it needs to be removed by surgery.

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

Human stomach acid is strong enough to dissolve small pieces of metal such as razor blades or staples.

Drug-induced pharmacodynamic effects manifested in older adults include drug-induced renal toxicity, which can be a major factor when these adults are experiencing other kidney problems.