|

|

|

Immunoglobulin injections may give short-term protection against, or reduce severity of certain diseases. They help people who have an inherited problem making their own antibodies, or those who are having certain types of cancer treatments.

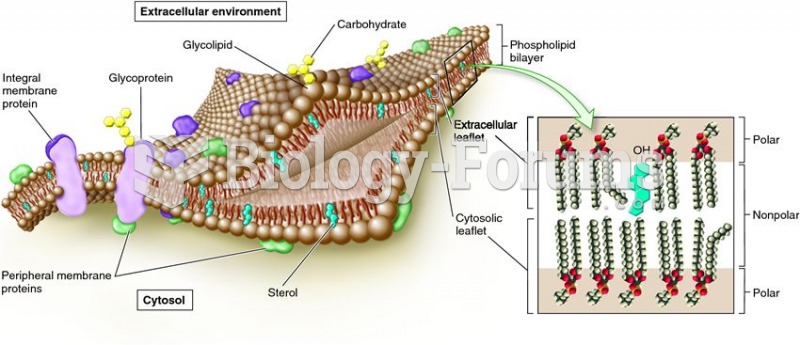

The lipid bilayer is made of phospholipids. They are arranged in a double layer because one of their ends is attracted to water while the other is repelled by water.

There are 60,000 miles of blood vessels in every adult human.

For pediatric patients, intravenous fluids are the most commonly cited products involved in medication errors that are reported to the USP.

Limit intake of red meat and dairy products made with whole milk. Choose skim milk, low-fat or fat-free dairy products. Limit fried food. Use healthy oils when cooking.