|

|

|

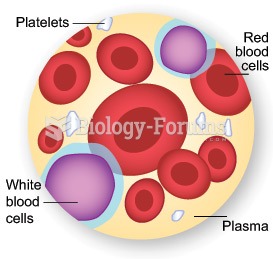

More than nineteen million Americans carry the factor V gene that causes blood clots, pulmonary embolism, and heart disease.

Everyone has one nostril that is larger than the other.

As of mid-2016, 18.2 million people were receiving advanced retroviral therapy (ART) worldwide. This represents between 43–50% of the 34–39.8 million people living with HIV.

Aspirin may benefit 11 different cancers, including those of the colon, pancreas, lungs, prostate, breasts, and leukemia.

Although the Roman numeral for the number 4 has always been taught to have been "IV," according to historians, the ancient Romans probably used "IIII" most of the time. This is partially backed up by the fact that early grandfather clocks displayed IIII for the number 4 instead of IV. Early clockmakers apparently thought that the IIII balanced out the VIII (used for the number 8) on the clock face and that it just looked better.