|

|

|

The average adult has about 21 square feet of skin.

The top 10 most important tips that will help you grow old gracefully include (1) quit smoking, (2) keep your weight down, (3) take supplements, (4) skip a meal each day or fast 1 day per week, (5) get a pet, (6) get medical help for chronic pain, (7) walk regularly, (8) reduce arguments, (9) put live plants in your living space, and (10) do some weight training.

Astigmatism is the most common vision problem. It may accompany nearsightedness or farsightedness. It is usually caused by an irregularly shaped cornea, but sometimes it is the result of an irregularly shaped lens. Either type can be corrected by eyeglasses, contact lenses, or refractive surgery.

Historic treatments for rheumatoid arthritis have included gold salts, acupuncture, a diet consisting of apples or rhubarb, nutmeg, nettles, bee venom, bracelets made of copper, prayer, rest, tooth extractions, fasting, honey, vitamins, insulin, snow collected on Christmas, magnets, and electric convulsion therapy.

The most destructive flu epidemic of all times in recorded history occurred in 1918, with approximately 20 million deaths worldwide.

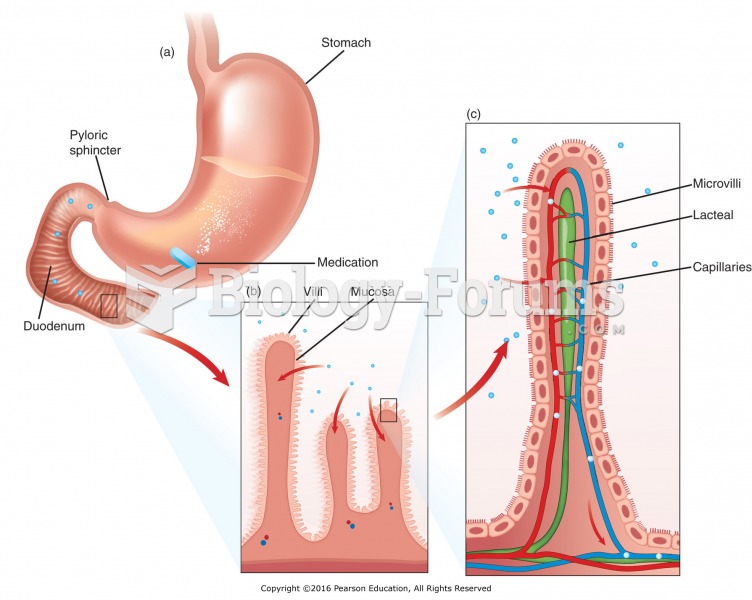

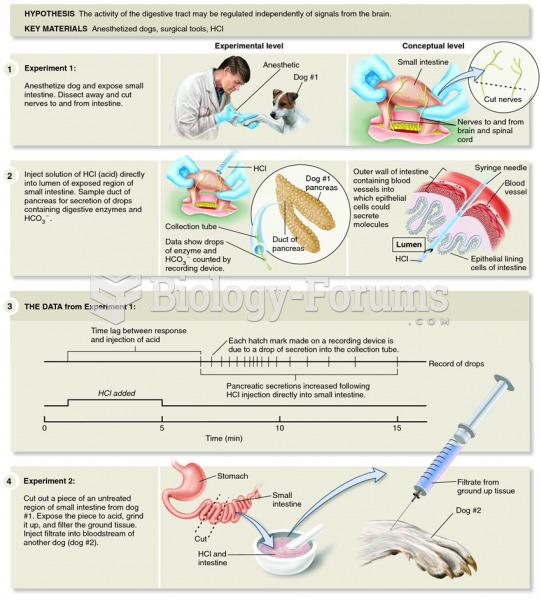

Bayliss and Starling discovered the mechanism by which the small intestine and pancreas work togethe

Bayliss and Starling discovered the mechanism by which the small intestine and pancreas work togethe

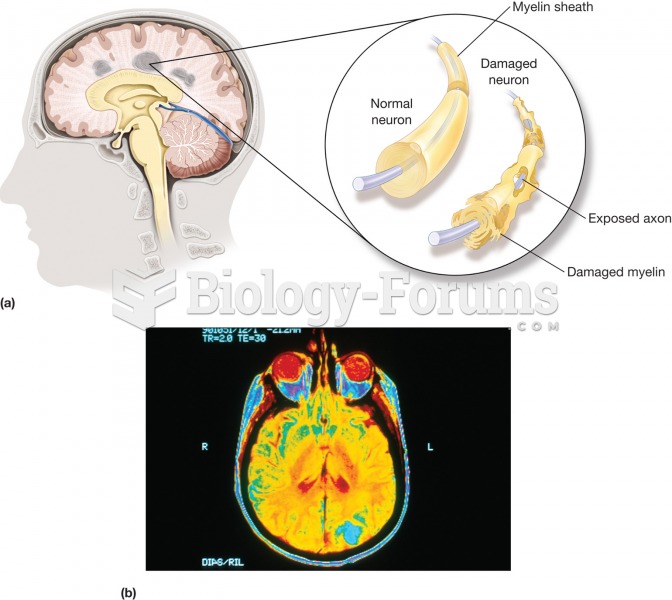

Multiple sclerosis (MS). (a) A disease characterized by the gradual development of small areas of ha

Multiple sclerosis (MS). (a) A disease characterized by the gradual development of small areas of ha