|

|

|

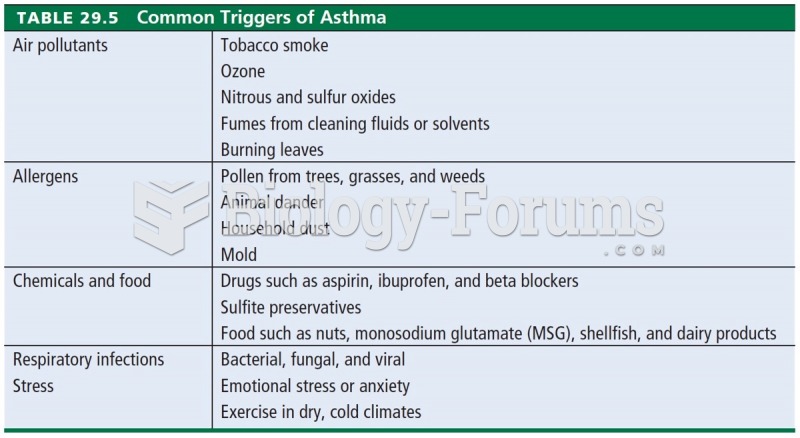

Asthma-like symptoms were first recorded about 3,500 years ago in Egypt. The first manuscript specifically written about asthma was in the year 1190, describing a condition characterized by sudden breathlessness. The treatments listed in this manuscript include chicken soup, herbs, and sexual abstinence.

Drying your hands with a paper towel will reduce the bacterial count on your hands by 45–60%.

To maintain good kidney function, you should drink at least 3 quarts of water daily. Water dilutes urine and helps prevent concentrations of salts and minerals that can lead to kidney stone formation. Chronic dehydration is a major contributor to the development of kidney stones.

According to the American College of Allergy, Asthma & Immunology, more than 50 million Americans have some kind of food allergy. Food allergies affect between 4 and 6% of children, and 4% of adults, according to the CDC. The most common food allergies include shellfish, peanuts, walnuts, fish, eggs, milk, and soy.

In ancient Rome, many of the richer people in the population had lead-induced gout. The reason for this is unclear. Lead poisoning has also been linked to madness.