|

|

|

Pubic lice (crabs) are usually spread through sexual contact. You cannot catch them by using a public toilet.

The most destructive flu epidemic of all times in recorded history occurred in 1918, with approximately 20 million deaths worldwide.

Serum cholesterol testing in adults is recommended every 1 to 5 years. People with diabetes and a family history of high cholesterol should be tested even more frequently.

Signs and symptoms that may signify an eye tumor include general blurred vision, bulging eye(s), double vision, a sensation of a foreign body in the eye(s), iris defects, limited ability to move the eyelid(s), limited ability to move the eye(s), pain or discomfort in or around the eyes or eyelids, red or pink eyes, white or cloud spots on the eye(s), colored spots on the eyelid(s), swelling around the eyes, swollen eyelid(s), and general vision loss.

Asthma is the most common chronic childhood disease in the world. Most children who develop asthma have symptoms before they are 5 years old.

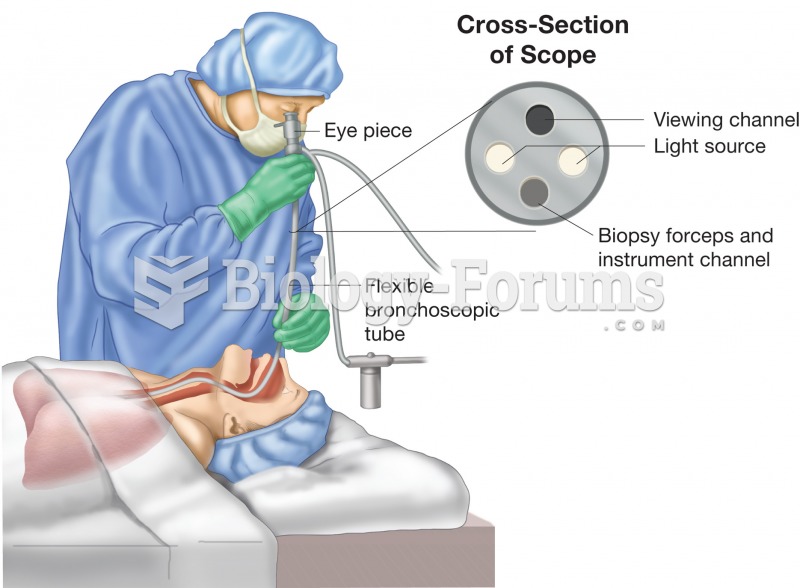

Bronchoscopy. Figure illustrates physician using a bronchoscope to inspect the patient’s bronchial t

Bronchoscopy. Figure illustrates physician using a bronchoscope to inspect the patient’s bronchial t

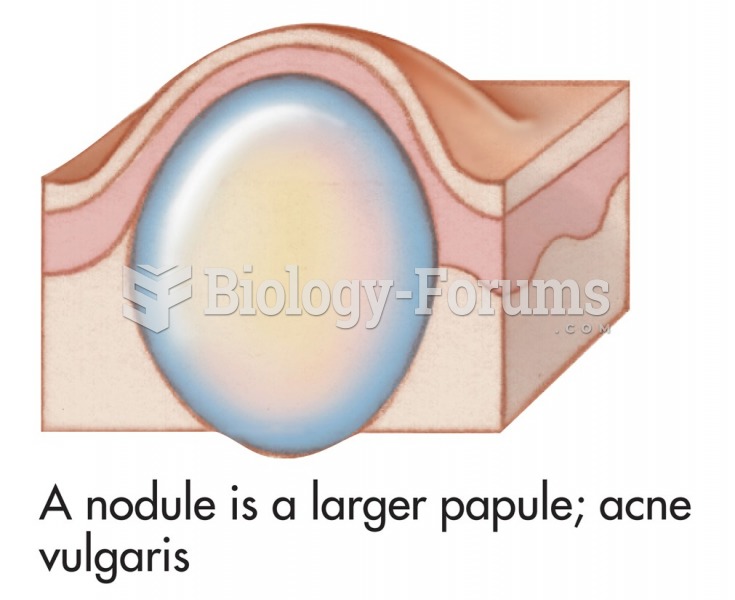

Common skin signs are often evidence of an illness or disorder. A nodule is a larger papule; acne ...

Common skin signs are often evidence of an illness or disorder. A nodule is a larger papule; acne ...