|

|

|

Opium has influenced much of the world's most popular literature. The following authors were all opium users, of varying degrees: Lewis Carroll, Charles, Dickens, Arthur Conan Doyle, and Oscar Wilde.

GI conditions that will keep you out of the U.S. armed services include ulcers, varices, fistulas, esophagitis, gastritis, congenital abnormalities, inflammatory bowel disease, enteritis, colitis, proctitis, duodenal diverticula, malabsorption syndromes, hepatitis, cirrhosis, cysts, abscesses, pancreatitis, polyps, certain hemorrhoids, splenomegaly, hernias, recent abdominal surgery, GI bypass or stomach stapling, and artificial GI openings.

Pope Sylvester II tried to introduce Arabic numbers into Europe between the years 999 and 1003, but their use did not catch on for a few more centuries, and Roman numerals continued to be the primary number system.

The first war in which wide-scale use of anesthetics occurred was the Civil War, and 80% of all wounds were in the extremities.

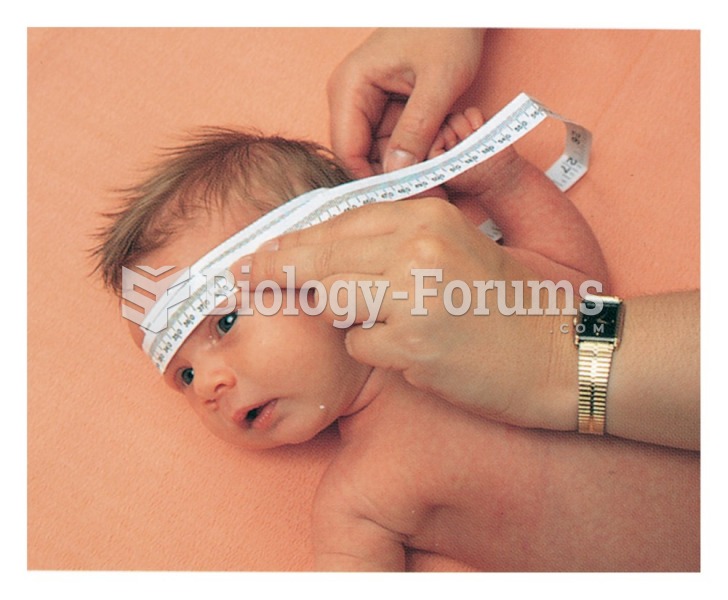

In the ancient and medieval periods, dysentery killed about ? of all babies before they reach 12 months of age. The disease was transferred through contaminated drinking water, because there was no way to adequately dispose of sewage, which contaminated the water.