|

|

|

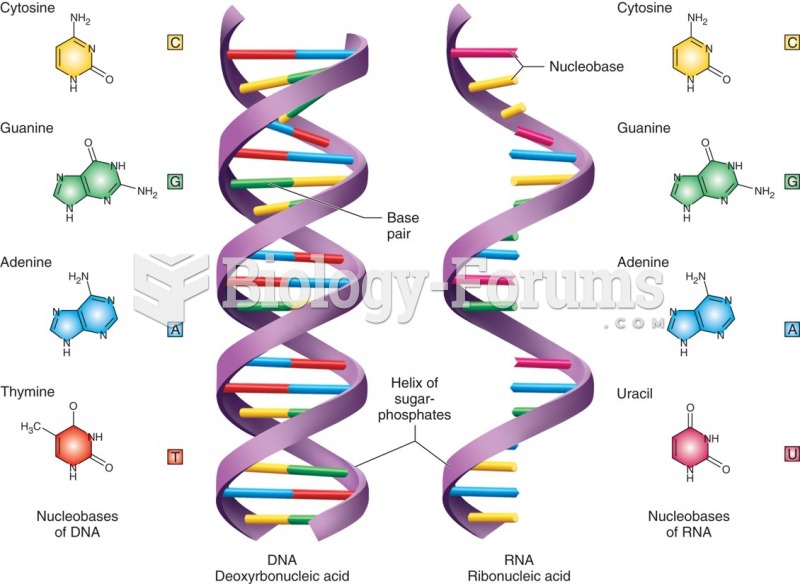

Multiple experimental evidences have confirmed that at the molecular level, cancer is caused by lesions in cellular DNA.

The liver is the only organ that has the ability to regenerate itself after certain types of damage. As much as 25% of the liver can be removed, and it will still regenerate back to its original shape and size. However, the liver cannot regenerate after severe damage caused by alcohol.

Computer programs are available that crosscheck a new drug's possible trade name with all other trade names currently available. These programs detect dangerous similarities between names and alert the manufacturer of the drug.

Eating food that has been cooked with poppy seeds may cause you to fail a drug screening test, because the seeds contain enough opiate alkaloids to register as a positive.

The first war in which wide-scale use of anesthetics occurred was the Civil War, and 80% of all wounds were in the extremities.