|

|

|

Addicts to opiates often avoid treatment because they are afraid of withdrawal. Though unpleasant, with proper management, withdrawal is rarely fatal and passes relatively quickly.

Giardia is one of the most common intestinal parasites worldwide, and infects up to 20% of the world population, mostly in poorer countries with inadequate sanitation. Infections are most common in children, though chronic Giardia is more common in adults.

Green tea is able to stop the scent of garlic or onion from causing bad breath.

The first-known contraceptive was crocodile dung, used in Egypt in 2000 BC. Condoms were also reportedly used, made of animal bladders or intestines.

Cocaine was isolated in 1860 and first used as a local anesthetic in 1884. Its first clinical use was by Sigmund Freud to wean a patient from morphine addiction. The fictional character Sherlock Holmes was supposed to be addicted to cocaine by injection.

At breakfast, a middle-class husband sits absorbed in the newspaper and the public affairs of the da

At breakfast, a middle-class husband sits absorbed in the newspaper and the public affairs of the da

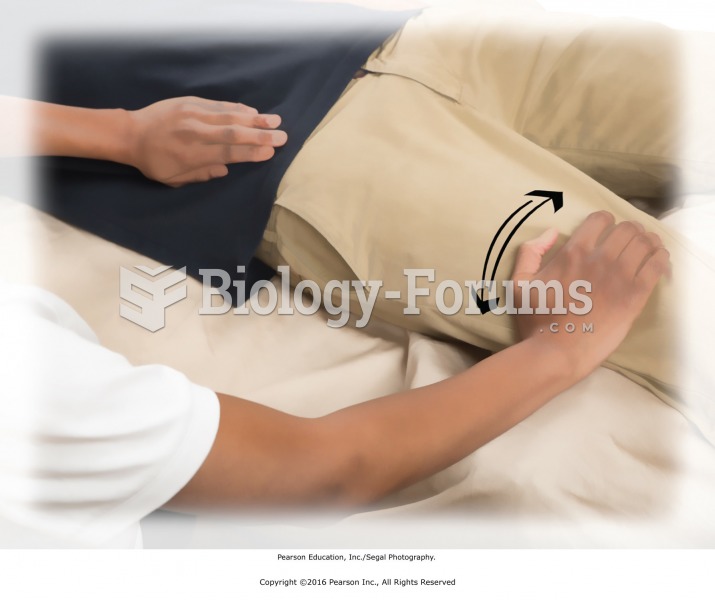

Stretch the extensor muscles with flexion at the wrist. Reposition the palm to face the table. Apply ...

Stretch the extensor muscles with flexion at the wrist. Reposition the palm to face the table. Apply ...