This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

More than 50% of American adults have oral herpes, which is commonly known as "cold sores" or "fever blisters." The herpes virus can be active on the skin surface without showing any signs or causing any symptoms.

Did you know?

Eat fiber! A diet high in fiber can help lower cholesterol levels by as much as 10%.

Did you know?

Your heart beats over 36 million times a year.

Did you know?

About 100 new prescription or over-the-counter drugs come into the U.S. market every year.

Did you know?

The first oncogene was discovered in 1970 and was termed SRC (pronounced "SARK").

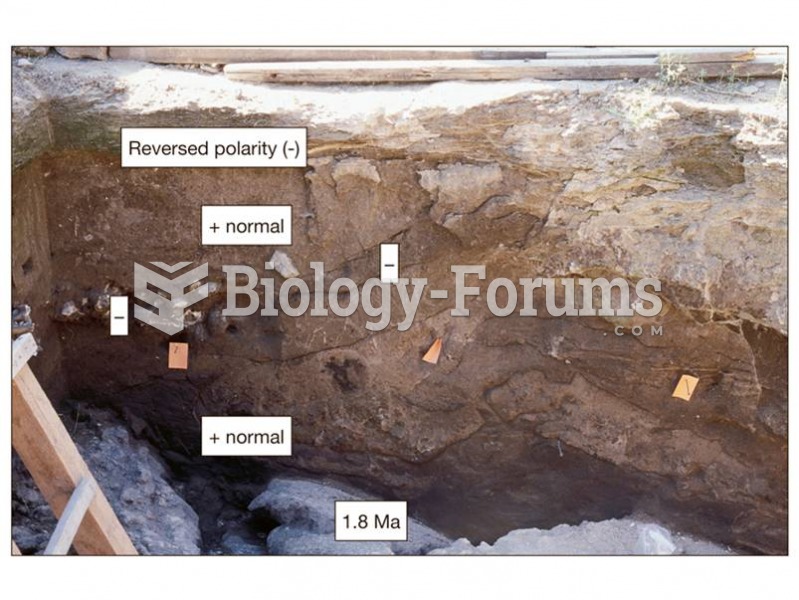

The basalt below the hominins is dated to 1.8 million years ago, and the geomagnetic polarity of the

The basalt below the hominins is dated to 1.8 million years ago, and the geomagnetic polarity of the

The recent mass upheavals in Tunisia, Egypt, Libya, Yemen, and Syria gave political scientists a cha

The recent mass upheavals in Tunisia, Egypt, Libya, Yemen, and Syria gave political scientists a cha