|

|

|

Stevens-Johnson syndrome and Toxic Epidermal Necrolysis syndrome are life-threatening reactions that can result in death. Complications include permanent blindness, dry-eye syndrome, lung damage, photophobia, asthma, chronic obstructive pulmonary disease, permanent loss of nail beds, scarring of mucous membranes, arthritis, and chronic fatigue syndrome. Many patients' pores scar shut, causing them to retain heat.

No drugs are available to relieve parathyroid disease. Parathyroid disease is caused by a parathyroid tumor, and it needs to be removed by surgery.

HIV testing reach is still limited. An estimated 40% of people with HIV (more than 14 million) remain undiagnosed and do not know their infection status.

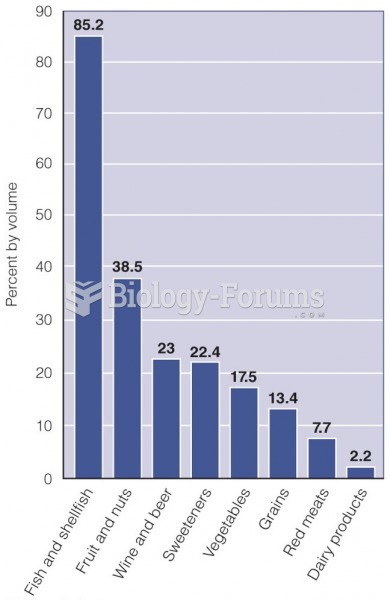

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.

Malaria mortality rates are falling. Increased malaria prevention and control measures have greatly improved these rates. Since 2000, malaria mortality rates have fallen globally by 60% among all age groups, and by 65% among children under age 5.