|

|

|

The newest statin drug, rosuvastatin, has been called a superstatin because it appears to reduce LDL cholesterol to a greater degree than the other approved statin drugs.

A seasonal flu vaccine is the best way to reduce the chances you will get seasonal influenza and spread it to others.

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

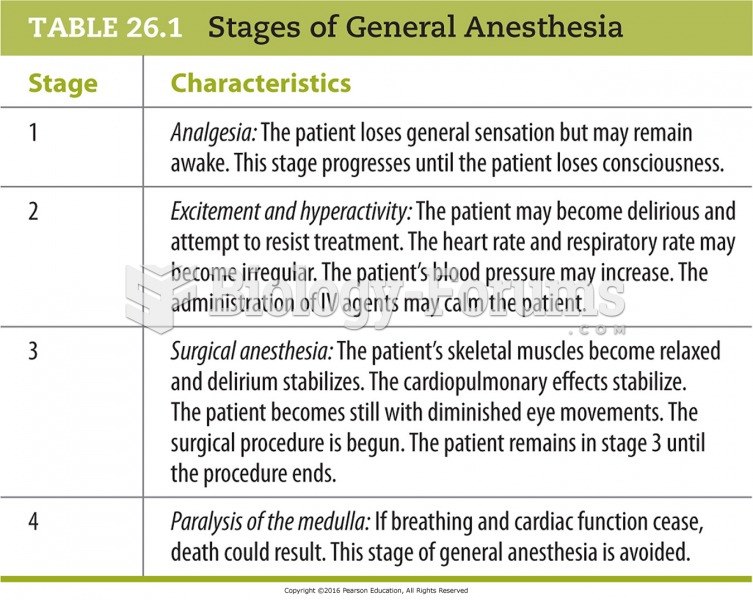

Anesthesia awareness is a potentially disturbing adverse effect wherein patients who have been paralyzed with muscle relaxants may awaken. They may be aware of their surroundings but unable to communicate or move. Neurologic monitoring equipment that helps to more closely check the patient's anesthesia stages is now available to avoid the occurrence of anesthesia awareness.

In most climates, 8 to 10 glasses of water per day is recommended for adults. The best indicator for adequate fluid intake is frequent, clear urination.