|

|

|

Asthma occurs in one in 11 children and in one in 12 adults. African Americans and Latinos have a higher risk for developing asthma than other groups.

Before a vaccine is licensed in the USA, the Food and Drug Administration (FDA) reviews it for safety and effectiveness. The CDC then reviews all studies again, as well as the American Academy of Pediatrics and the American Academy of Family Physicians. Every lot of vaccine is tested before administration to the public, and the FDA regularly inspects vaccine manufacturers' facilities.

In 1844, Charles Goodyear obtained the first patent for a rubber condom.

Historic treatments for rheumatoid arthritis have included gold salts, acupuncture, a diet consisting of apples or rhubarb, nutmeg, nettles, bee venom, bracelets made of copper, prayer, rest, tooth extractions, fasting, honey, vitamins, insulin, snow collected on Christmas, magnets, and electric convulsion therapy.

Asthma is the most common chronic childhood disease in the world. Most children who develop asthma have symptoms before they are 5 years old.

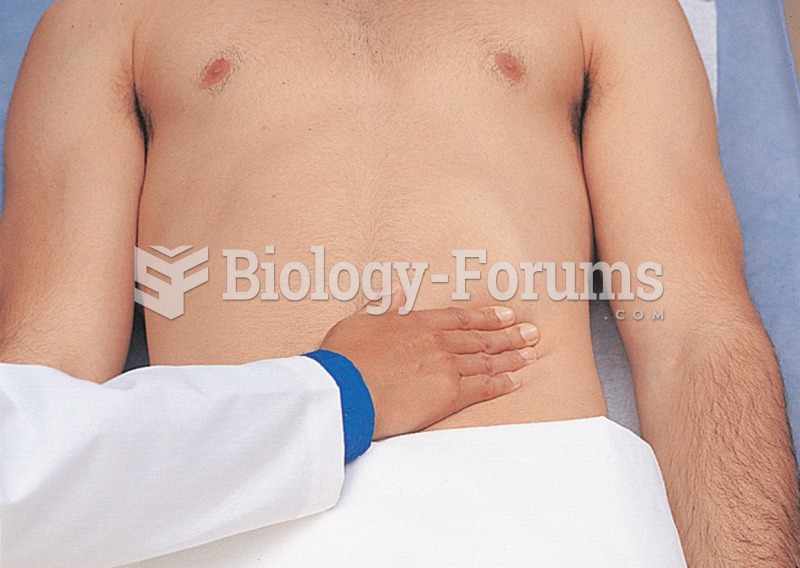

A client is having an endoscopy performed by a physician who views the upper gastrointestinal intern

A client is having an endoscopy performed by a physician who views the upper gastrointestinal intern

The Abecedarian study was designed to help very low-income African American children prepare for ...

The Abecedarian study was designed to help very low-income African American children prepare for ...