Answer to Question 1Current practices of slotting fees, i.e. the payment by manufactures of fees to retailers to display and sell their products, are morally problematic.

Slotting fees if they are to be justified must accurately reflect the retailer's cost and risk in displaying a product.

There is strong evidence this is not the case.

Therefore slotting fees are morally problematic.

Objections Considered

Retailers must assume the risk of allocating limited shelf space to a new product.

Retailers must absorb the cost of warehousing a product, accounting for it in inventory, bar-coding it and stocking the shelves with it.

In some cases, the retailer must also incur the cost of promoting the product.

down over time, even if a product sells well. Neither do these considerations explain why slotting fees are non-uniform and why they are not typically reported on retailers' books as revenues offset by inventory costs, advertising costs, and warehousing fees. Because slotting fees are non-uniform and even non-universal, it is impossible to understand how the fee structure works, how much the fees should be, and whether the fees are actually related to the costs incurred by retailers in getting a new product to the shelf. ...Market entry rights are unclear, fees change, not everyone is permitted to buy into the system and the use and declaration of revenues is unknown.

Answer to Question 2Insider trading is both morally and economically indefensible. ote: Arguments 1-3 are in support of the claim that insider trading is unethical. Argument 4 is in support of the claim that it cannot be defended on economic grounds.

- Given that insider trading is presently illegal, it confers an unfair advantage to those prepared to break the law.

- Even if legalized, insider trading would be immoral, since it violates fairness, inasmuch as the same information is not available to everyone.

- Even if legalized, insider trading would be unacceptable since it frequently leads to a company's right to keep certain information private, insofar as it tends to result in information being leaked to those who have no right to that information.

- Insider trading cannot be defended on economic grounds, since it undermines competition between equally matched parties. Insofar as it undermines competition, it undermines the possibility of an efficient market.

- Insider trading would not be morally objectionable if it were legalized.

- Insider trading is justified on the basis that it leads to a more accurate valuing of a stock and hence to a more efficient market.

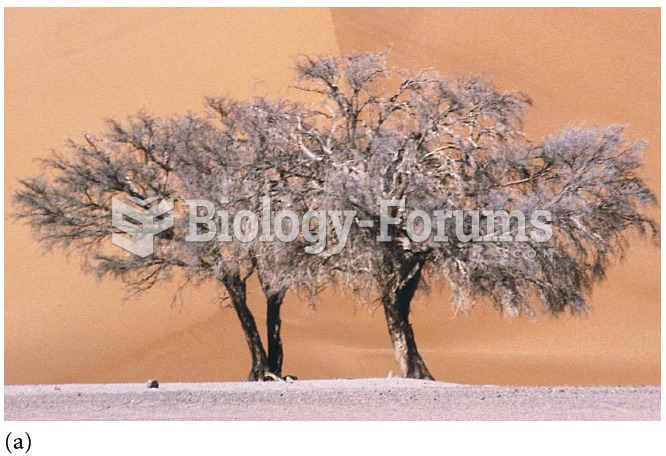

Deserts differ across the world. (a) Acacia trees between a gravel plain and sand dunes in the Namib

Deserts differ across the world. (a) Acacia trees between a gravel plain and sand dunes in the Namib

Succession in the intertidal zone involves colonization and competition for limited space among spec

Succession in the intertidal zone involves colonization and competition for limited space among spec