|

|

|

According to the FDA, adverse drug events harmed or killed approximately 1,200,000 people in the United States in the year 2015.

Limit intake of red meat and dairy products made with whole milk. Choose skim milk, low-fat or fat-free dairy products. Limit fried food. Use healthy oils when cooking.

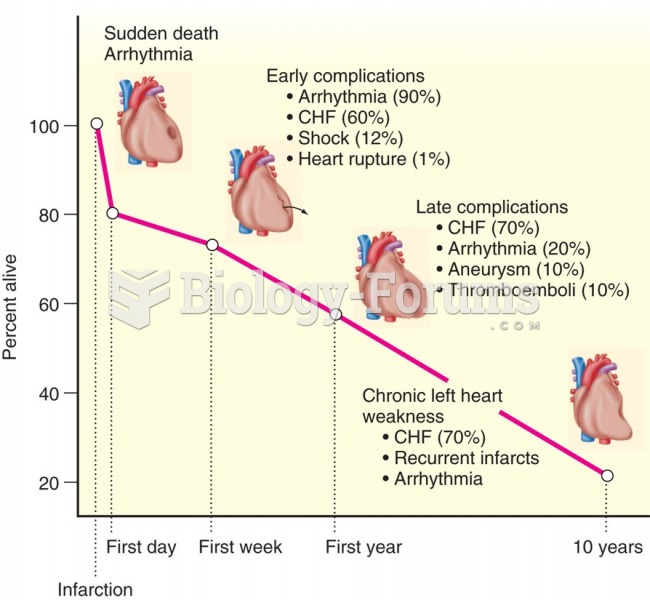

More than nineteen million Americans carry the factor V gene that causes blood clots, pulmonary embolism, and heart disease.

The word drug comes from the Dutch word droog (meaning "dry"). For centuries, most drugs came from dried plants, hence the name.

Automated pill dispensing systems have alarms to alert patients when the correct dosing time has arrived. Most systems work with many varieties of medications, so patients who are taking a variety of drugs can still be in control of their dose regimen.