|

|

|

There are approximately 3 million unintended pregnancies in the United States each year.

All adverse reactions are commonly charted in red ink in the patient's record and usually are noted on the front of the chart. Failure to follow correct documentation procedures may result in malpractice lawsuits.

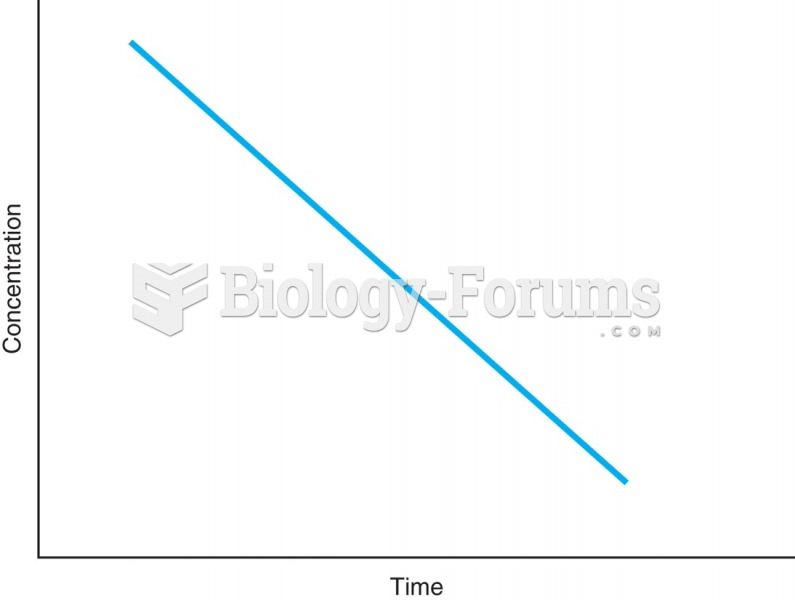

Drug-induced pharmacodynamic effects manifested in older adults include drug-induced renal toxicity, which can be a major factor when these adults are experiencing other kidney problems.

The lipid bilayer is made of phospholipids. They are arranged in a double layer because one of their ends is attracted to water while the other is repelled by water.

People who have myopia, or nearsightedness, are not able to see objects at a distance but only up close. It occurs when the cornea is either curved too steeply, the eye is too long, or both. This condition is progressive and worsens with time. More than 100 million people in the United States are nearsighted, but only 20% of those are born with the condition. Diet, eye exercise, drug therapy, and corrective lenses can all help manage nearsightedness.