|

|

|

As many as 28% of hospitalized patients requiring mechanical ventilators to help them breathe (for more than 48 hours) will develop ventilator-associated pneumonia. Current therapy involves intravenous antibiotics, but new antibiotics that can be inhaled (and more directly treat the infection) are being developed.

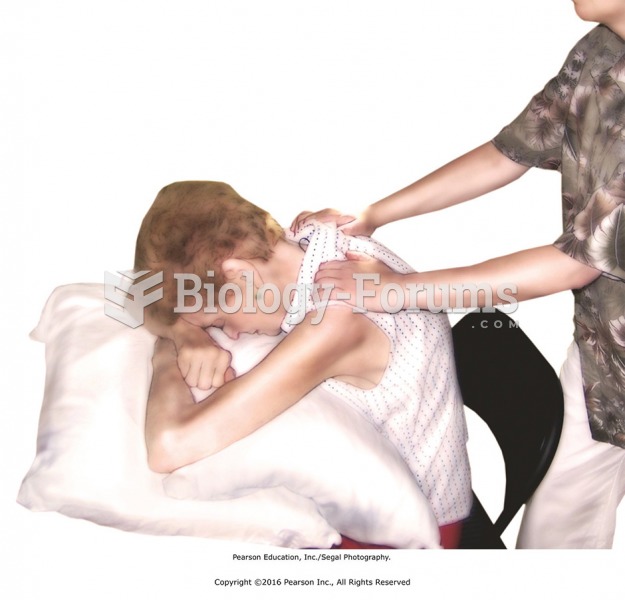

Approximately one in three babies in the United States is now delivered by cesarean section. The number of cesarean sections in the United States has risen 46% since 1996.

Aspirin may benefit 11 different cancers, including those of the colon, pancreas, lungs, prostate, breasts, and leukemia.

Parkinson's disease is both chronic and progressive. This means that it persists over a long period of time and that its symptoms grow worse over time.

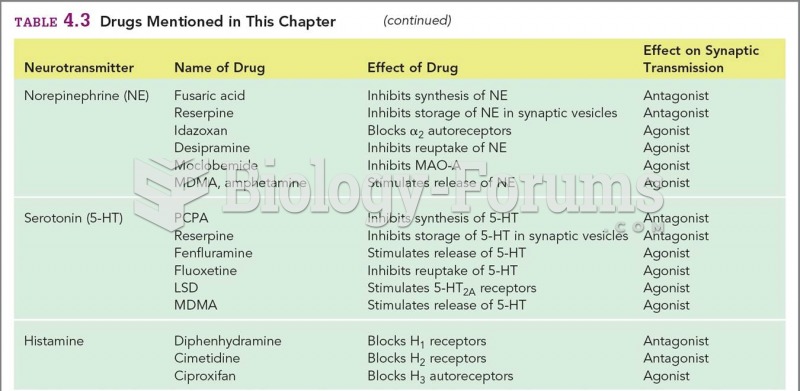

Drug abusers experience the following scenario: The pleasure given by their drug (or drugs) of choice is so strong that it is difficult to eradicate even after years of staying away from the substances involved. Certain triggers may cause a drug abuser to relapse. Research shows that long-term drug abuse results in significant changes in brain function that persist long after an individual stops using drugs. It is most important to realize that the same is true of not just illegal substances but alcohol and tobacco as well.