|

|

|

Eat fiber! A diet high in fiber can help lower cholesterol levels by as much as 10%.

Approximately 15–25% of recognized pregnancies end in miscarriage. However, many miscarriages often occur before a woman even knows she is pregnant.

An identified risk factor for osteoporosis is the intake of excessive amounts of vitamin A. Dietary intake of approximately double the recommended daily amount of vitamin A, by women, has been shown to reduce bone mineral density and increase the chances for hip fractures compared with women who consumed the recommended daily amount (or less) of vitamin A.

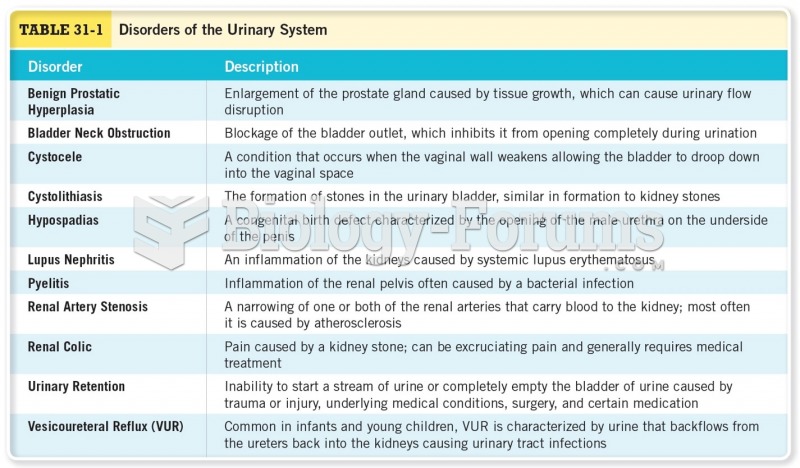

Your chance of developing a kidney stone is 1 in 10. In recent years, approximately 3.7 million people in the United States were diagnosed with a kidney disease.

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.