|

|

|

There are approximately 3 million unintended pregnancies in the United States each year.

The largest baby ever born weighed more than 23 pounds but died just 11 hours after his birth in 1879. The largest surviving baby was born in October 2009 in Sumatra, Indonesia, and weighed an astounding 19.2 pounds at birth.

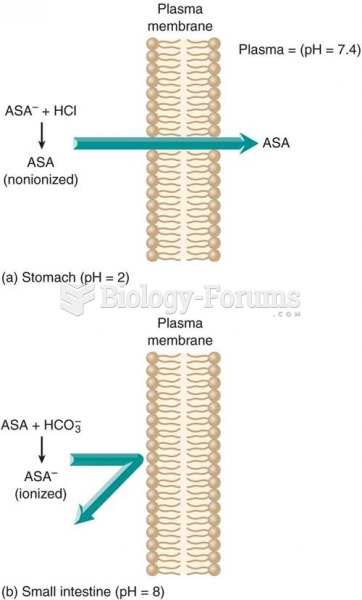

The use of salicylates dates back 2,500 years to Hippocrates’s recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

In 1844, Charles Goodyear obtained the first patent for a rubber condom.

It is believed that the Incas used anesthesia. Evidence supports the theory that shamans chewed cocoa leaves and drilled holes into the heads of patients (letting evil spirits escape), spitting into the wounds they made. The mixture of cocaine, saliva, and resin numbed the site enough to allow hours of drilling.