|

|

|

Adolescents often feel clumsy during puberty because during this time of development, their hands and feet grow faster than their arms and legs do. The body is therefore out of proportion. One out of five adolescents actually experiences growing pains during this period.

There can actually be a 25-hour time difference between certain locations in the world. The International Date Line passes between the islands of Samoa and American Samoa. It is not a straight line, but "zig-zags" around various island chains. Therefore, Samoa and nearby islands have one date, while American Samoa and nearby islands are one day behind. Daylight saving time is used in some islands, but not in others—further shifting the hours out of sync with natural time.

Anesthesia awareness is a potentially disturbing adverse effect wherein patients who have been paralyzed with muscle relaxants may awaken. They may be aware of their surroundings but unable to communicate or move. Neurologic monitoring equipment that helps to more closely check the patient's anesthesia stages is now available to avoid the occurrence of anesthesia awareness.

Most fungi that pathogenically affect humans live in soil. If a person is not healthy, has an open wound, or is immunocompromised, a fungal infection can be very aggressive.

Malaria mortality rates are falling. Increased malaria prevention and control measures have greatly improved these rates. Since 2000, malaria mortality rates have fallen globally by 60% among all age groups, and by 65% among children under age 5.

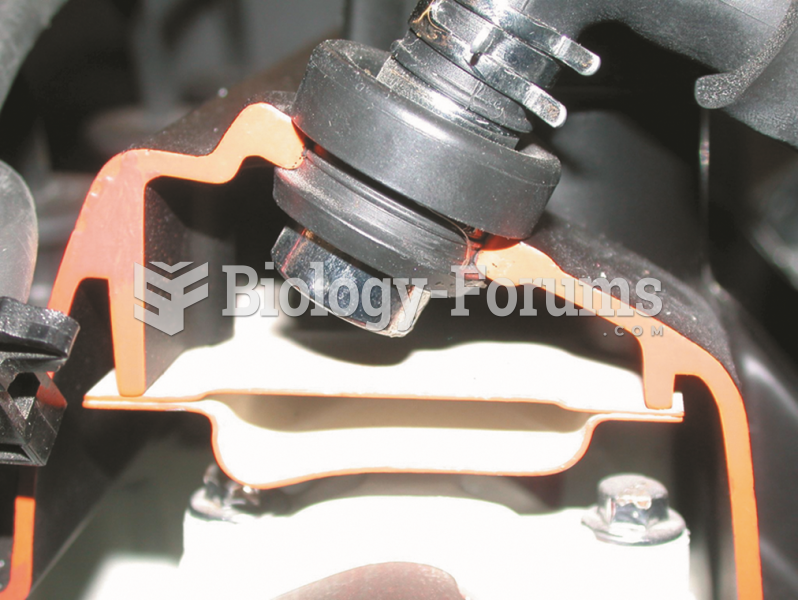

One danger of a wire fence is that, as shown in this photo, it is practically invisible; a running a

One danger of a wire fence is that, as shown in this photo, it is practically invisible; a running a

As China has embraced its version of capitalism, wealth has grown, as has consumption. Luxury goods ...

As China has embraced its version of capitalism, wealth has grown, as has consumption. Luxury goods ...