|

|

|

People with high total cholesterol have about two times the risk for heart disease as people with ideal levels.

Hip fractures are the most serious consequences of osteoporosis. The incidence of hip fractures increases with each decade among patients in their 60s to patients in their 90s for both women and men of all populations. Men and women older than 80 years of age show the highest incidence of hip fractures.

Acute bronchitis is an inflammation of the breathing tubes (bronchi), which causes increased mucus production and other changes. It is usually caused by bacteria or viruses, can be serious in people who have pulmonary or cardiac diseases, and can lead to pneumonia.

If you use artificial sweeteners, such as cyclamates, your eyes may be more sensitive to light. Other factors that will make your eyes more sensitive to light include use of antibiotics, oral contraceptives, hypertension medications, diuretics, and antidiabetic medications.

Many supplement containers do not even contain what their labels say. There are many documented reports of products containing much less, or more, that what is listed on their labels. They may also contain undisclosed prescription drugs and even contaminants.

Photograph of the flea that transmits Yersinia pestis to cause bubonic plague, called the oriental r

Photograph of the flea that transmits Yersinia pestis to cause bubonic plague, called the oriental r

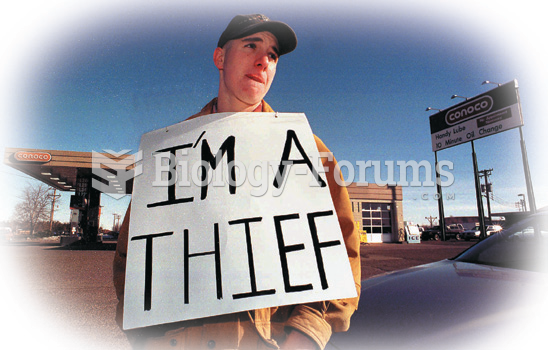

This 19-year-old in Wisconsin was given a reduced jail sentence for holding this sign in front of ...

This 19-year-old in Wisconsin was given a reduced jail sentence for holding this sign in front of ...