|

|

|

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

Most childhood vaccines are 90–99% effective in preventing disease. Side effects are rarely serious.

Only one in 10 cancer deaths is caused by the primary tumor. The vast majority of cancer mortality is caused by cells breaking away from the main tumor and metastasizing to other parts of the body, such as the brain, bones, or liver.

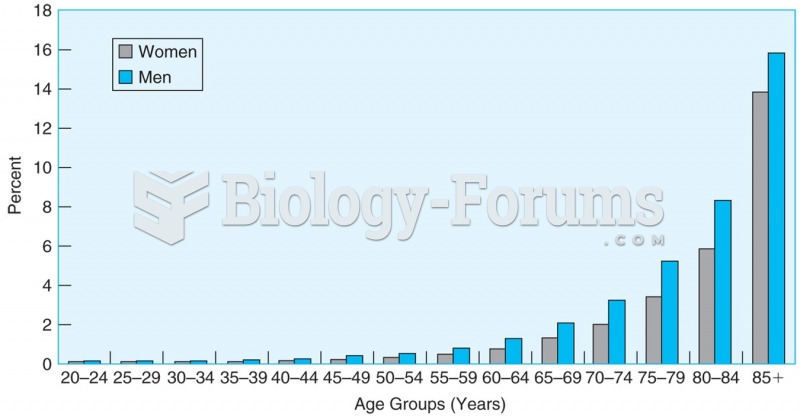

The senior population grows every year. Seniors older than 65 years of age now comprise more than 13% of the total population. However, women outlive men. In the 85-and-over age group, there are only 45 men to every 100 women.

Anesthesia awareness is a potentially disturbing adverse effect wherein patients who have been paralyzed with muscle relaxants may awaken. They may be aware of their surroundings but unable to communicate or move. Neurologic monitoring equipment that helps to more closely check the patient's anesthesia stages is now available to avoid the occurrence of anesthesia awareness.