|

|

|

Complications of influenza include: bacterial pneumonia, ear and sinus infections, dehydration, and worsening of chronic conditions such as asthma, congestive heart failure, or diabetes.

About one in five American adults and teenagers have had a genital herpes infection—and most of them don't know it. People with genital herpes have at least twice the risk of becoming infected with HIV if exposed to it than those people who do not have genital herpes.

Pubic lice (crabs) are usually spread through sexual contact. You cannot catch them by using a public toilet.

A seasonal flu vaccine is the best way to reduce the chances you will get seasonal influenza and spread it to others.

There are actually 60 minerals, 16 vitamins, 12 essential amino acids, and three essential fatty acids that your body needs every day.

A passenger train crosses Stony Creek Bridge in the Rocky Mountains in 1878. Railroads were importan

A passenger train crosses Stony Creek Bridge in the Rocky Mountains in 1878. Railroads were importan

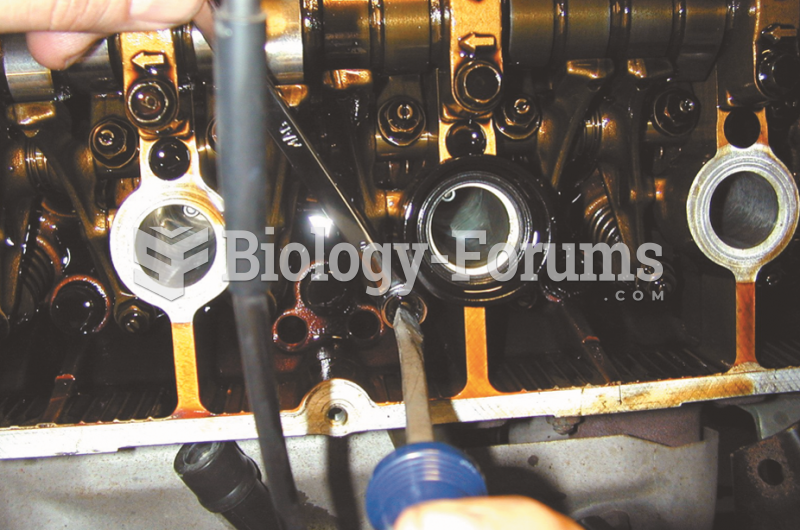

Adjusting a valve takes both hands—one to hold the wrench to loosen and tighten the lock nut and ...

Adjusting a valve takes both hands—one to hold the wrench to loosen and tighten the lock nut and ...