|

|

|

During pregnancy, a woman is more likely to experience bleeding gums and nosebleeds caused by hormonal changes that increase blood flow to the mouth and nose.

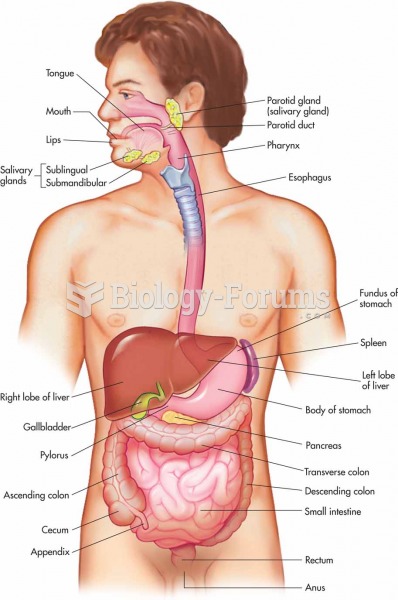

Acetaminophen (Tylenol) in overdose can seriously damage the liver. It should never be taken by people who use alcohol heavily; it can result in severe liver damage and even a condition requiring a liver transplant.

Coca-Cola originally used coca leaves and caffeine from the African kola nut. It was advertised as a therapeutic agent and "pickerupper." Eventually, its formulation was changed, and the coca leaves were removed because of the effects of regulation on cocaine-related products.

HIV testing reach is still limited. An estimated 40% of people with HIV (more than 14 million) remain undiagnosed and do not know their infection status.

The liver is the only organ that has the ability to regenerate itself after certain types of damage. As much as 25% of the liver can be removed, and it will still regenerate back to its original shape and size. However, the liver cannot regenerate after severe damage caused by alcohol.