|

|

|

The first-known contraceptive was crocodile dung, used in Egypt in 2000 BC. Condoms were also reportedly used, made of animal bladders or intestines.

Today, nearly 8 out of 10 pregnant women living with HIV (about 1.1 million), receive antiretrovirals.

Though methadone is often used to treat dependency on other opioids, the drug itself can be abused. Crushing or snorting methadone can achieve the opiate "rush" desired by addicts. Improper use such as these can lead to a dangerous dependency on methadone. This drug now accounts for nearly one-third of opioid-related deaths.

Though “Krazy Glue” or “Super Glue” has the ability to seal small wounds, it is not recommended for this purpose since it contains many substances that should not enter the body through the skin, and may be harmful.

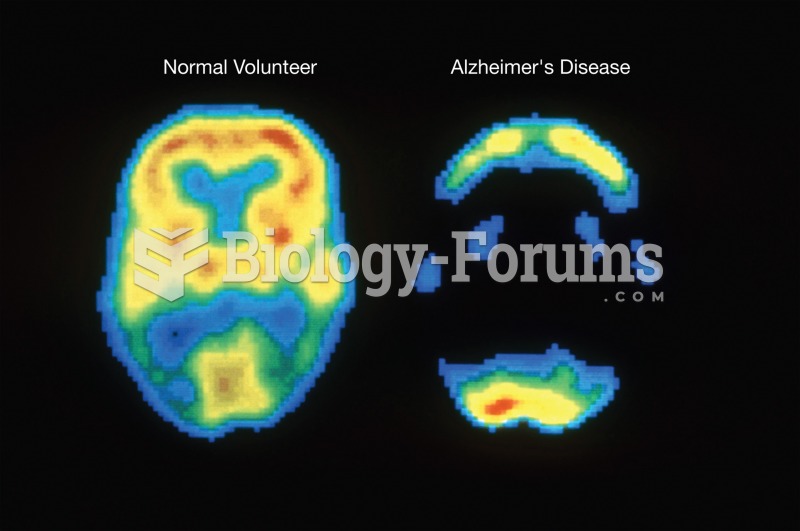

Drug abusers experience the following scenario: The pleasure given by their drug (or drugs) of choice is so strong that it is difficult to eradicate even after years of staying away from the substances involved. Certain triggers may cause a drug abuser to relapse. Research shows that long-term drug abuse results in significant changes in brain function that persist long after an individual stops using drugs. It is most important to realize that the same is true of not just illegal substances but alcohol and tobacco as well.