|

|

|

The term pharmacology is derived from the Greek words pharmakon("claim, medicine, poison, or remedy") and logos ("study").

In 2006, a generic antinausea drug named ondansetron was approved. It is used to stop nausea and vomiting associated with surgery, chemotherapy, and radiation therapy.

About 80% of major fungal systemic infections are due to Candida albicans. Another form, Candida peritonitis, occurs most often in postoperative patients. A rare disease, Candida meningitis, may follow leukemia, kidney transplant, other immunosuppressed factors, or when suffering from Candida septicemia.

Pubic lice (crabs) are usually spread through sexual contact. You cannot catch them by using a public toilet.

About 60% of newborn infants in the United States are jaundiced; that is, they look yellow. Kernicterus is a form of brain damage caused by excessive jaundice. When babies begin to be affected by excessive jaundice and begin to have brain damage, they become excessively lethargic.

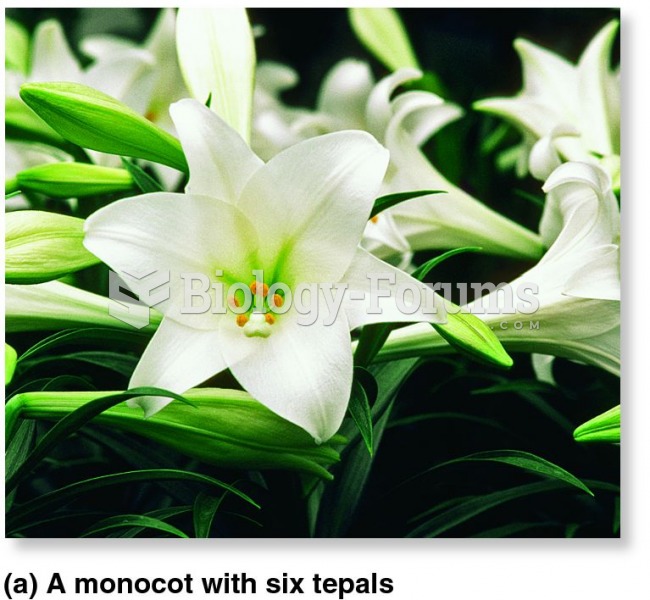

Flower part number is a characteristic difference between monocots and eudicots (a) Flowers and buds

Flower part number is a characteristic difference between monocots and eudicots (a) Flowers and buds

Young adulthood brings the greatest number of role transitions and highest levels of demands than ...

Young adulthood brings the greatest number of role transitions and highest levels of demands than ...