|

|

|

This year, an estimated 1.4 million Americans will have a new or recurrent heart attack.

The types of cancer that alpha interferons are used to treat include hairy cell leukemia, melanoma, follicular non-Hodgkin's lymphoma, and AIDS-related Kaposi's sarcoma.

The National Institutes of Health have supported research into acupuncture. This has shown that acupuncture significantly reduced pain associated with osteoarthritis of the knee, when used as a complement to conventional therapies.

Women are 50% to 75% more likely than men to experience an adverse drug reaction.

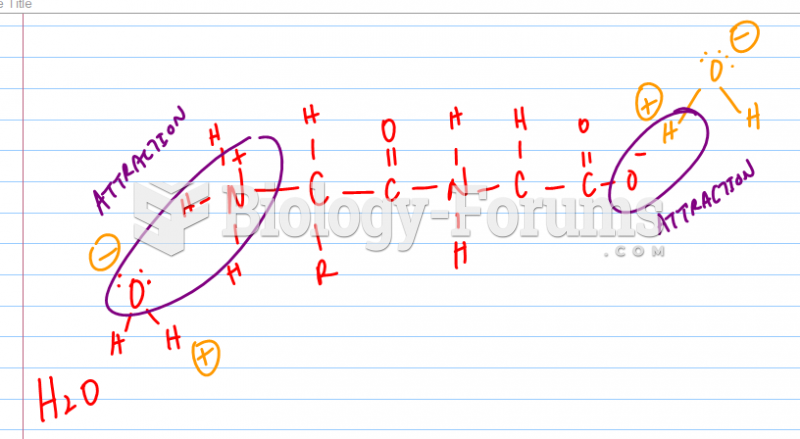

A good example of polar molecules can be understood when trying to make a cake. If water and oil are required, they will not mix together. If you put them into a measuring cup, the oil will rise to the top while the water remains on the bottom.