Answer to Question 1

Answer:

a. Traditional system:

Operating profit per unit for Brass faucets is 5 = 40 - (8 + 15 + 12)

Operating profit per unit for Chrome faucets is 10 = 20 - (4 + 3 + 3)

Operating profit per unit for White faucets is 4 = 30 - (8 + 9 + 9)

b. The activity-cost-driver rate for setup costs is 4,900 per setup hour = 465,500/95, and for inspection costs is 150 per inspection hour = 405,000/2,700.

c. ABC system:

Overhead costs per unit for Brass faucets are 9.40 per unit.

30,000 units in projected sales / 1,000 units per batch = 30 batches;

30 batches 1 setup hour per batch = 30 setup hours;

30 batches 30 inspection hours per batch = 900 inspection hours

30 setup hours 4,900 = 147,000/30,000 units = 4.90/unit

900 inspection hours 150 = 135,000/30,000 units = 4.50/unit

Overhead costs for Brass faucets (4.90 + 4.50) = 9.40 per unit

Operating profit per unit for Brass faucets is 7.60 = 40 - (8 + 15 + 9.40).

Overhead costs per unit for Chrome faucets are 5.45 per unit.

50,000 units in projected sales / 1,000 units per batch = 50 batches;

50 batches .5 setup hour per batch = 25 setup hours;

50 batches 20 inspection hours per batch = 1,000 inspection hours

25 setup hours 4,900 = 122,500/50,000 units = 2.45/unit

1,000 inspection hours 150 = 150,000/50,000 units = 3.00/unit

Overhead costs for Chrome faucets (2.45 + 3.00) = 5.45 per unit

Operating profit per unit for Chrome faucets is 7.55 = 20 - (4 + 3 + 5.45).

Overhead costs per unit for White faucets are 7.90 per unit.

40,000 units in projected sales/ 1,000 units per batch = 40 batches;

40 batches 1 setup hour per batch = 40 setup hours;

40 batches 20 inspection hours per batch = 800 inspection hours

40 setup hours 4,900 = 196,000/40,000 units = 4.90/unit

800 inspection hours 150 = 120,000/40,000 units = 3.00/unit

Overhead costs for white faucets (4.90 + 3.00) = 7.90 per unit.

Operating profit per unit for White faucets is 5.10 = 30 - (8 + 9 + 7.90).

d. Traditional system:

Operating profit per unit for Brass faucets is 5 = 40 - (8 + 15 + 12).

Operating profit per unit for Chrome faucets is 10 = 20 - (4 + 3 + 3).

Operating profit per unit for White faucets is 4 = 30 - (8 + 9 + 9).

ABC system:

Operating profit per unit for Brass faucets is 7.60 = 40 - (8 + 15 + 9.40).

Operating profit per unit for Chrome faucets is 7.55 = 20 - (4 + 3 + 5.45).

Operating profit per unit for White faucets is 5.10 = 30 - (8 + 9 + 7.90).

Because the products do not all require the same proportionate shares of the overhead resources of setup hours and inspection hours, the ABC system provides different results than the traditional system, which allocates overhead costs on the basis of direct labor hours. The ABC system considers some important differences in overhead resource requirements and thus provides a better picture of the profitability from each faucet style provided that the activity measures are fairly estimated.

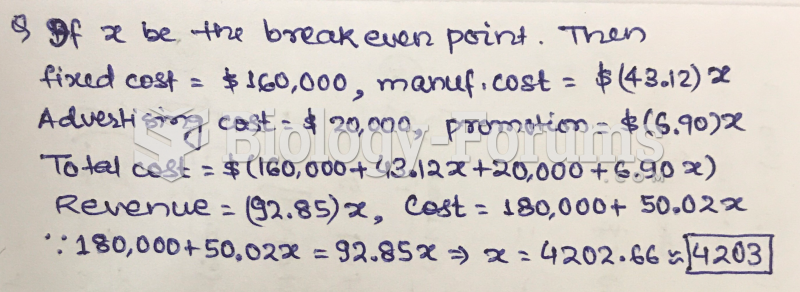

Answer to Question 2

Revenues